Give launches "Louise" AI for philanthropy.

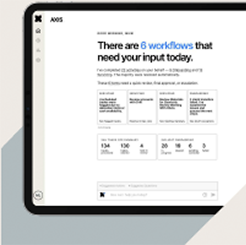

AXIS AI for middle office operations is here.

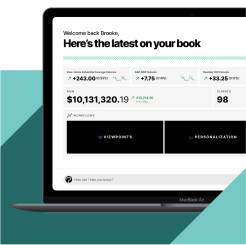

Magnifi

launches

"Why it

matters."

@Work and

HUB announce

multi-year

partnership.

The Platform for Financial AI

With an expanding platform serving wealth management, asset management, and insurance across front-office, middle-office and back-office needs in the US and abroad, TIFIN is helping financial services transform through the adoption of AI.

Investments: AI platforms that handle investment tasks and objectives for various personas such as the end-investor, advisor and enterprise investment teams.

Operations: AI platforms that automate and execute middle and back office operational functions such as onboarding, monitoring and servicing.

Distribution: AI platforms that help product and advice providers execute distribution and sales efforts more efficiently.

Trusted by asset managers, wealth managers, advisors, family offices, wealthtech providers, insurance providers and more.

In partnership with