Transition Private Foundations to Donor-Advised Funds

Transitioning from private foundations to donor-advised funds can be a strategic move for family offices supporting the philanthropic needs of UHNW clients.

[InvestmentNews] Give expands philanthropic planning support with single-charity fund option

TIFIN Give Introduces Single-Charity Fund Functionality, Expanding Advisors’ Philanthropic Planning Capabilities

New addition enhances tax-efficient giving strategies for high-net-worth clients while augmenting traditional donor-advised funds.

Preventing the Next-Gen Breakup: How Advisors Can Retain Assets Through Wealth Transfer

For high-net-worth families, wealth transfer isn’t just about money—it’s about legacy, values, and relationships. But too often, advisors focus solely on the wealth creators, failing to build trust with their heirs. The result? When assets transfer, so do advisory relationships. This Valentine’s Day, let’s talk about how to prevent the Next-Gen breakup.

Tax Advantages of Donor-Advised Funds

Donor-advised funds offer powerful tax benefits alongside charitable impact. From offsetting windfalls to donating non-cash assets and growing tax-free, DAFs give donors flexibility to maximize both their giving and their tax advantages.

Ready to Upgrade Your DAF Provider Post-Giving Season?

During Giving Season’s period of high-volume charitable activity, you may have uncovered frustrating inefficiencies in your current donor-advised fund (DAF) program. It may be time to transition to a modern DAF solution.

[Simple] Rethinking Philanthropy: The Role of Wealth Advisors and Technology in Meeting Modern Donor Expectations

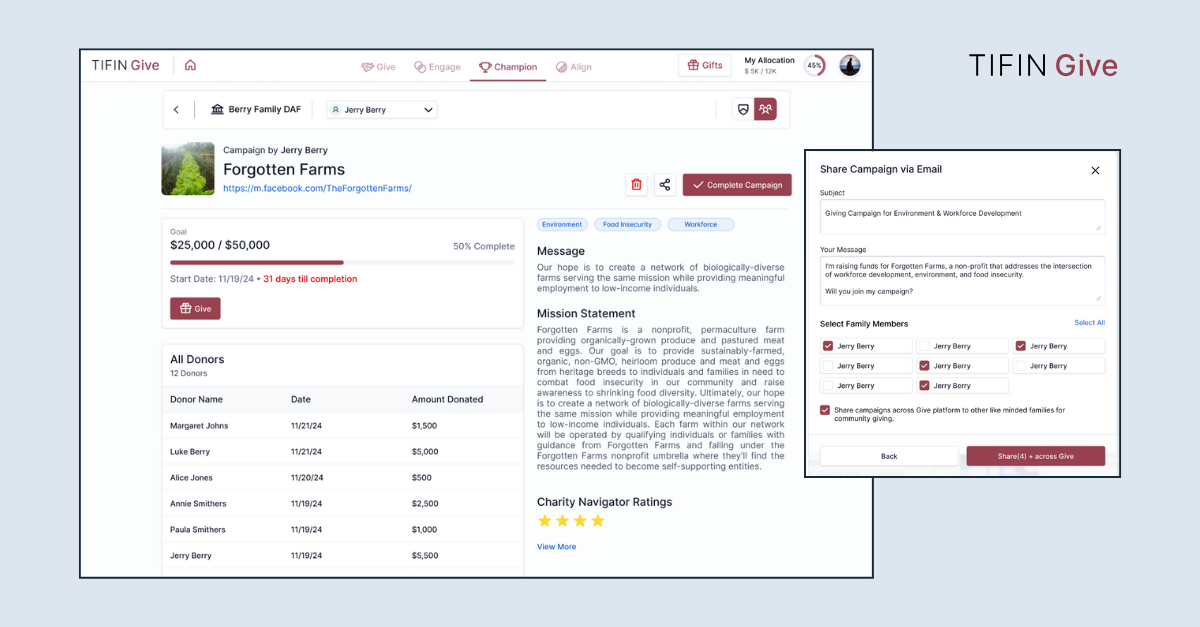

[Financial Planning] TIFIN Give Feature Allows for Public DAF Campaigns

TIFIN Give’s recently released feature allows for public campaigns via donor-advised funds (DAFs) to encourage others to join donors in supporting causes they care about without using an external platform.

The Wealth Transfer $18 Trillion Philanthropy Opportunity

Approximately $18 trillion of the $124 trillion Great Wealth Transfer is expected to go to charity. To explore these trends and innovations, we spoke with Paul Lussow, CEO of TIFIN Give — a next-generation, digital charitable giving platform.

[Financial Advisor Magazine] The Wealth Transfer $18 Trillion Philanthropy Opportunity

To explore these trends and innovations, we spoke with Paul Lussow, CEO of TIFIN Give — a next-generation, digital charitable giving platform within the TIFIN ecosystem.