The AI

co-pilot for private markets.

Helix empowers wealth advisors and wealth enterprises to navigate private markets with confidence by simplifying fund discovery, fund evaluation, and product implementation.

Why private markets matter now

12% annual growth projected in retail wealth invested in alts.1

86%

of advisors say alts set their practice apart.2

63%

of advisors believe alts attract new clients.2

76%

of advisors allocate more than 5% to alternatives in their client portfolios.2

97%

of asset managers report strong retail interest in private markets.3

Simplify the complex

Private markets were once limited to institutional investors due to high minimums, low liquidity, and limited wealth channel access. In the past decade, new products have emerged, yet barriers persist—complex structures, inconsistent data, and limited access to timely fund and manager information.

Helix’s new Asset Allocation Assistant helps overcome these hurdles by guiding advisors through fund selection and portfolio construction, turning complexity into clarity, and delivering clear, risk-aligned allocations in seconds.

Selecting alternative investments is time consuming

Sourcing products

Locating and sorting through available or approved funds across disparate data sources to source new deals.

Research process

Fund due diligence using PPMs, marketing materials, such as fact sheets and pitch decks, and public filings is tedious.

Portfolio implementation

Identifying appropriate investment solutions from an approved list and building an asset allocation for public and private investments is complex and manual.

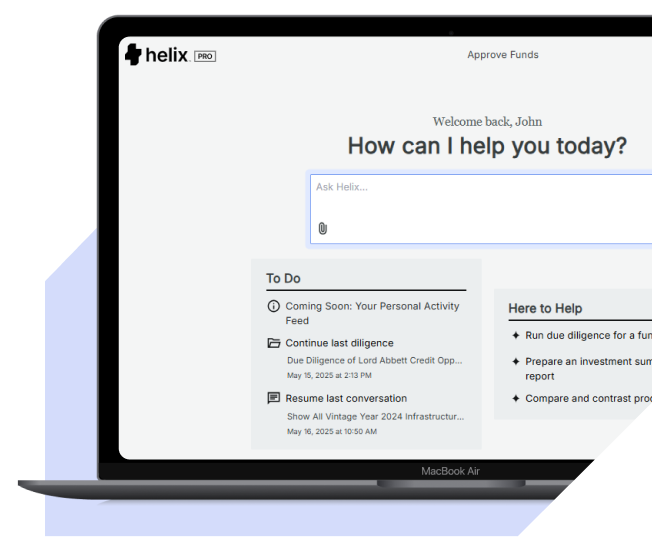

We provide answers to your questions

Helix, the AI-powered assistant developed through a strategic collaboration between TIFIN and Hamilton Lane, transforms complex private market data into clear, actionable intelligence for wealth management firms.

Select your solution based on your needs

Built in partnership with a leading private markets investment manager...

- 34 years in business

- 100% private markets focused

- $956.1B+ assets under management and supervision – inclusive of $134.9B in discretionary assets under management and $821.2B in non-discretionary assets under management, as of 12/31/2024.

How Helix works

Helix deciphers your request and directs it to the right data source.

Helix aligns your query with relevant data for precise answers.

Helix provides clear, actionable recommendations.