Elevate your practice with intelligent private markets solutions

Helix RIA makes private market investing more accessible, powering advisors to educate clients with confidence and deliver exceptional service. With AI-powered insights, exclusive data, and a simplified framework, Helix RIA helps advisors effectively communicate complex investment opportunities—ensuring more clients gain access to the benefits of alternative investments.

Conduct analysis on funds in our database, or add your own

- Firm AUM

- Prior fund details

- Firm covered asset classes

- Asset class and focus

- Geographic focus

- Fund type

- Target fund size & maximum fund size

- Liquidity profile

- Investment period terms

- Fund expenses, including carry and highwater mark

- GP commitment

- Target IRR

- Targeted number of holdings

- Investment period

- Harvest period

- Past performance

Overlay Helix’s AI capabilities onto any fund document

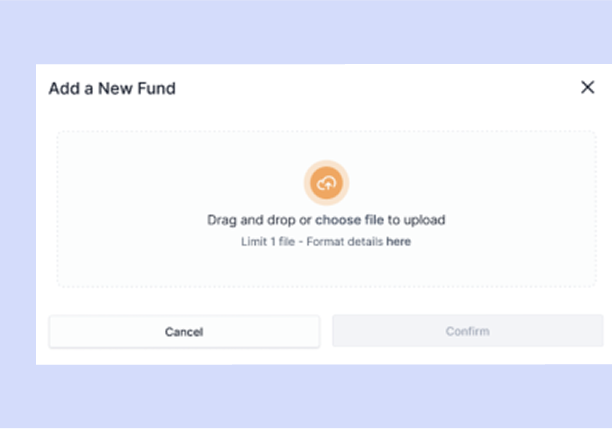

Custom document upload functionality makes it easy to overlay Helix’s AI capabilities for any fund offering document, pitchbook, and/or other marketing materials.

Upload your fund documents into Helix to get answers to your questions, generate investment reports, and run due diligence questionnaires seamlessly.

Features

Intelligent engine

Helix delivers personalized fund suggestions and asset allocation recommendations to streamline the implementation of alternative investments in client portfolios.

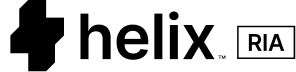

Real-time data integration

Helix integrates real-time data into text responses and analytical research, ensuring advisors always have up-to-date information.

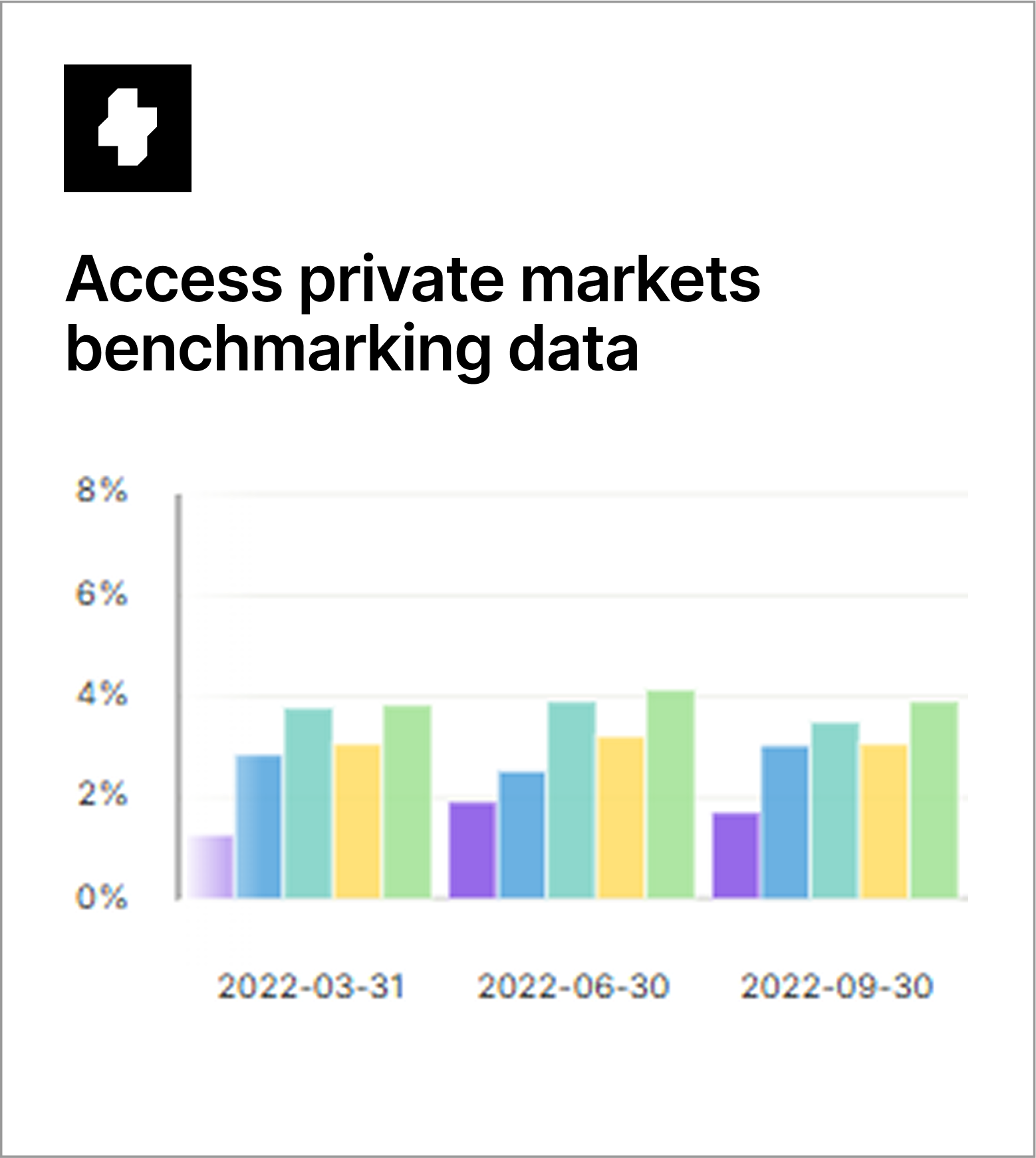

Expert workflows

From investment memos to manager diligence, Helix provides templates and capabilities to streamline complex documentation processes.

Private markets knowledge base

A vast repository of information covering a wide array of topics related to alternative investments, supporting both education and strategic decision-making.

Use cases for advisors

Helix assists RIAs in identifying, evaluating, and allocating more clients to diverse alternative investment opportunities, from private equity to real estate, helping to build robust and diversified client portfolios.

The platform’s educational tools and comprehensive data resources empower RIAs to educate their clients about the benefits and risks associated with private markets investments, fostering deeper client relationships.

With AI-powered insights and access to extensive data, RIAs can use Helix’s allocation and fund suggestion tools to quickly implement portfolios tailored to each client’s unique needs.

Helix allows the download of past conversations to provide support for fund analysis and ongoing monitoring efforts of existing holdings.

MONTHLY SUBSCRIPTION

Single Seat License

Learn more about a monthly plan to fit your needs

Key features:

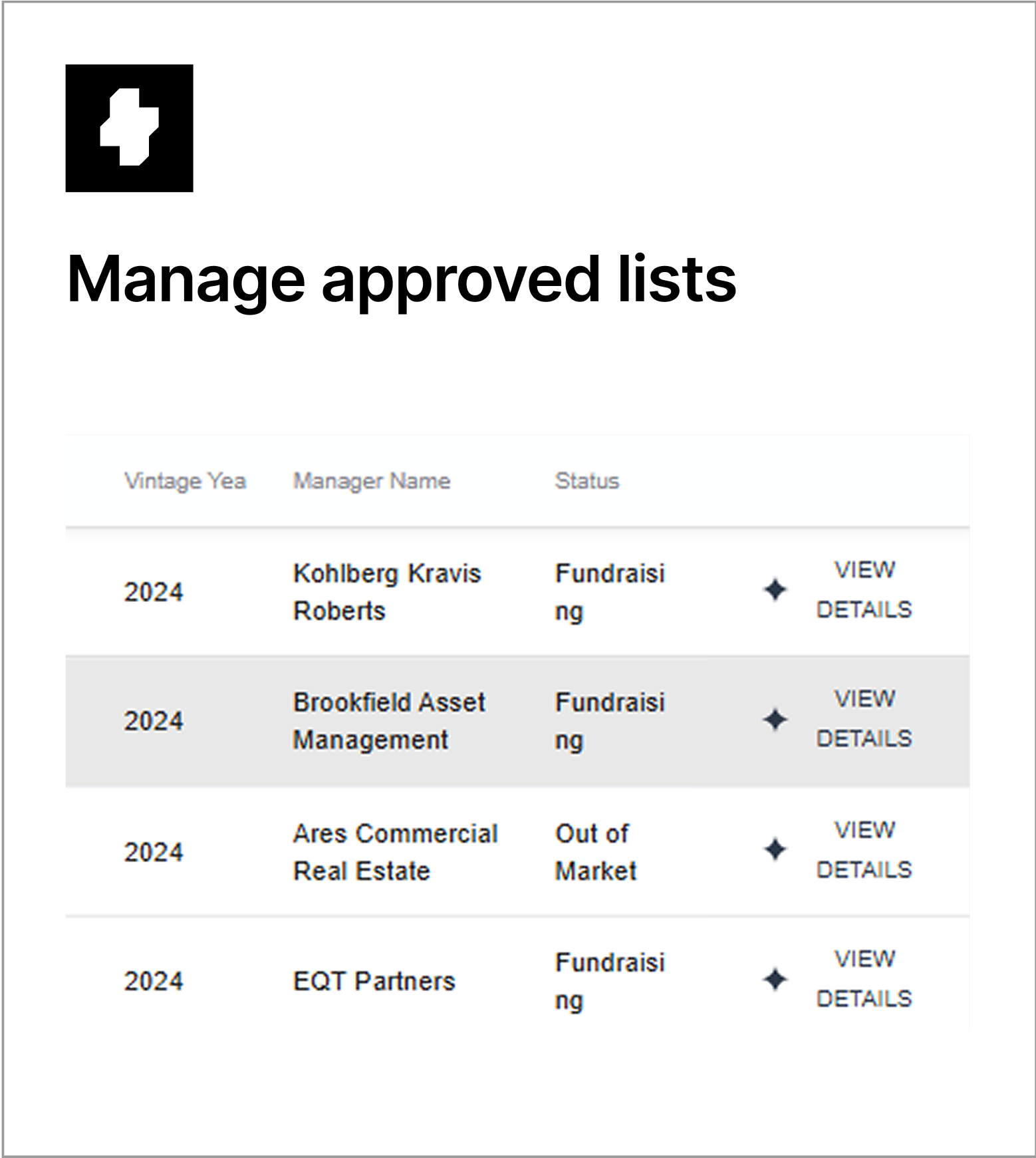

- Generate custom fund suggestions and asset allocation recommendations for your clients

- Compare and contrast funds within the Hamilton Lane and Blue Vault universe

- Access private market answers and product information 24/7

- Generate customizable fund reports, fund summaries, and performance reports

- Upload external documents for rapid analysis (offering documents, pitch decks, quarterly updates)