Streamlining private market distribution

Helix Pro empowers wealth enterprises, RIA teams, and family offices to seamlessly integrate alternative investments into client portfolios. By unifying data, enhancing product access, providing collaboration between business units, and automating compliance, Helix Pro not only streamlines due diligence but also enables firms to drive smarter investment decisions at scale.

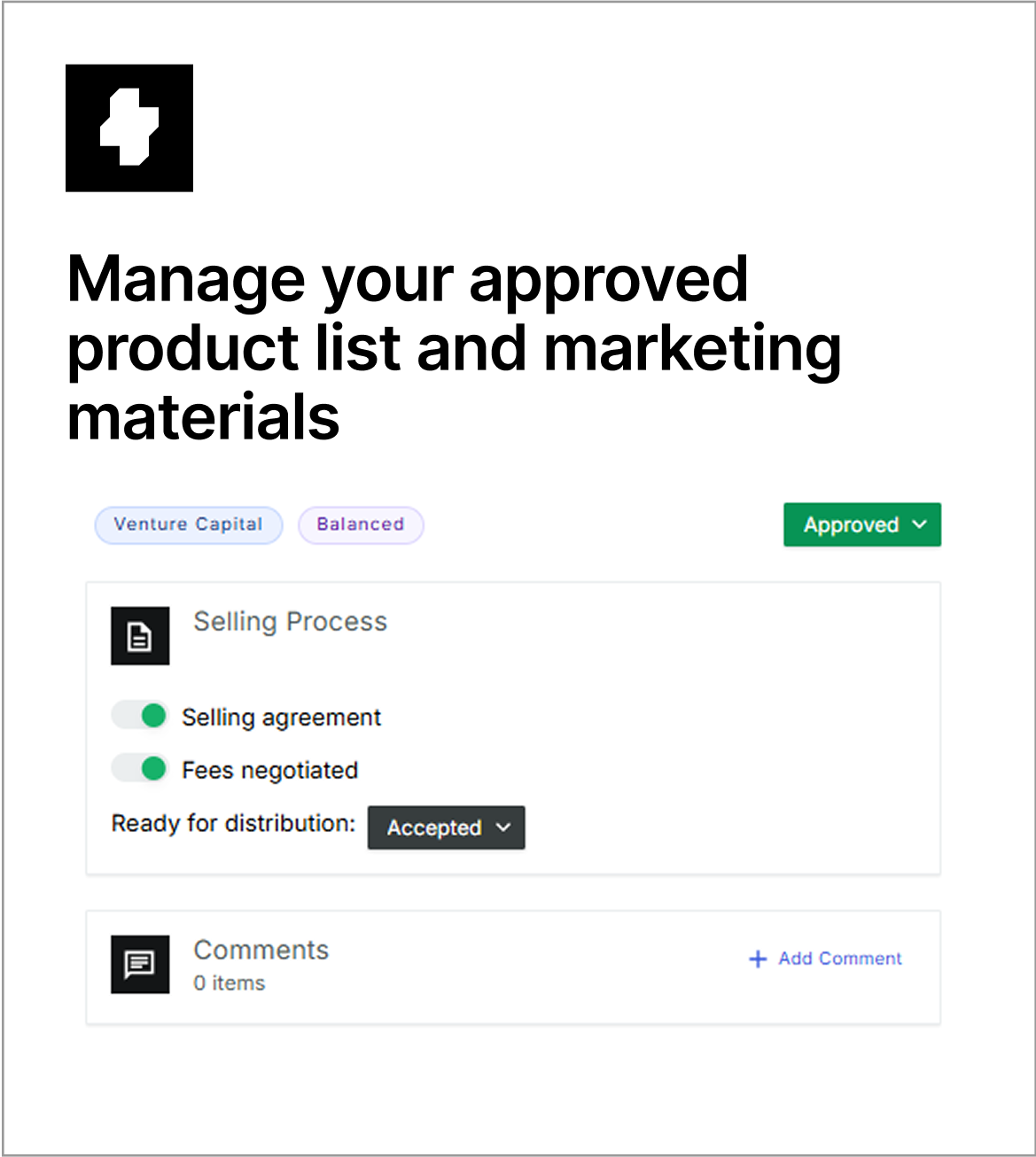

Increased collaboration with your key business partners

Features

Manager, fund and education material accessibility

Easily access needed information from Helix’s vast datasets and proprietary data uploaded by your firm using Helix’s AI tool trained exclusively for private markets

Fund comparisons and report generation

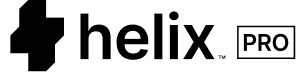

Helix streamlines fund screening, comparisons, and deep analysis for due diligence teams and advisors. Customizable fund summaries and due diligence questionnaires help streamline the fund review process to make faster, data-driven decisions.

Fund suggestions and asset allocation support

Through AI-driven insights and access to vast data sources, RIAs can make informed, data-driven decisions quickly around fund and portfolio implementation using Helix’s allocation and fund suggestion tools tailored to client-specific needs and characteristics.

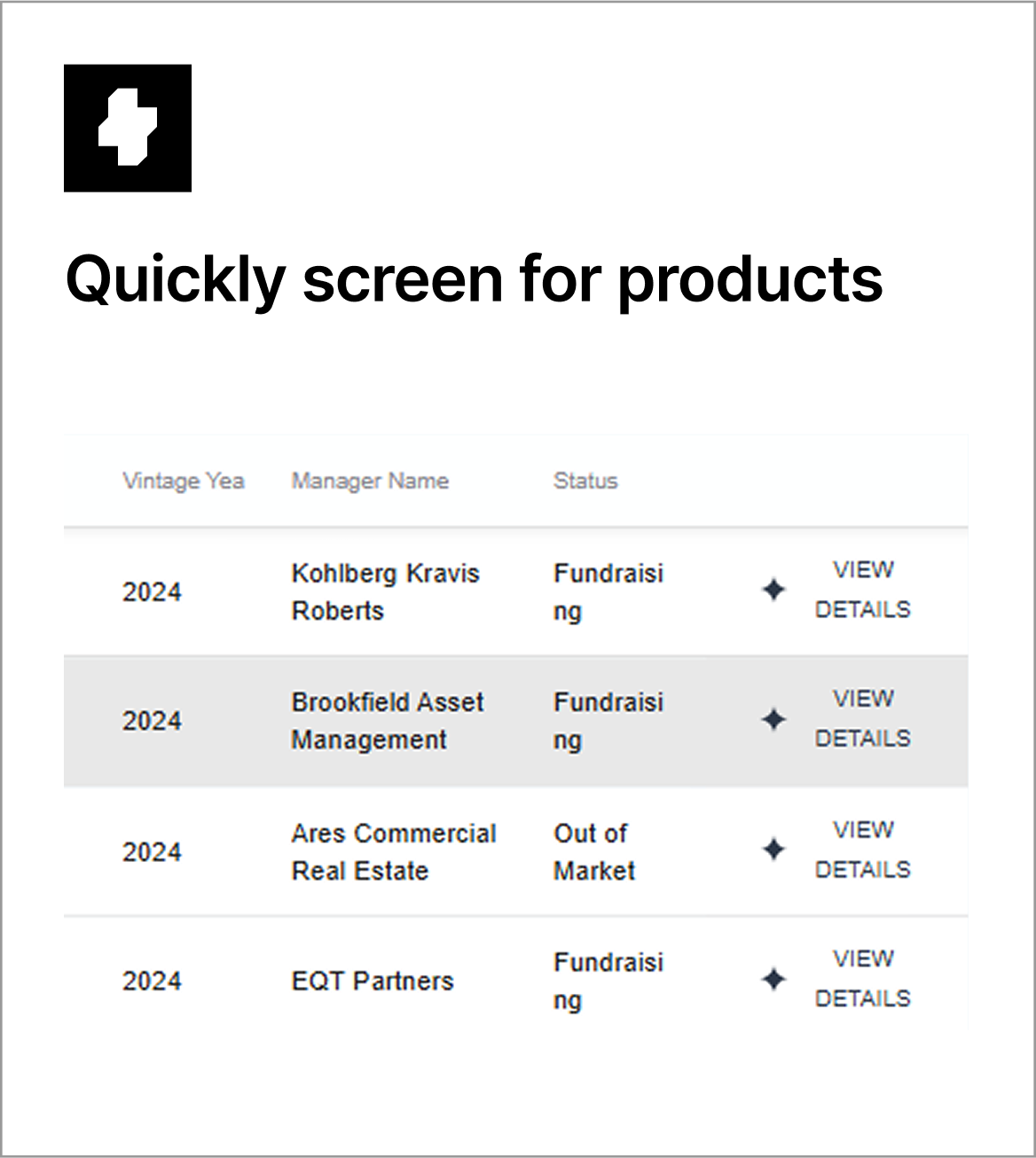

Custom fund lists and document management

Wealth enterprises can manage and distribute their lists of approved products and documents available for use by their advisors and clients.

Key benefits

Equip your sales team with the necessary information in real-time, reducing delays and enhancing decision-making.

Build stronger relationships with advisors and their clients by providing accurate and timely information about private market investments.

Remove frictions from the sales process with automated data extraction and customized communication tools.

Use cases for wealth enterprises

Simplify initial and ongoing product due diligence by leveraging Helix’s AI capabilities and data to parse and analyze fund documents, as well as automate due diligence and fund report generation.

Provide a curated fund list and documents of approved funds for use within your enterprise. Helix allows for notifications and alerts for new funds available or approved product updates for your approved list.

Helix provides information sharing between key business units – research, business, sales, compliance, and advisor support.

ENTERPRISE

Contact to learn more

Pricing tailored to your needs

Key features:

- Tailored for RIAs, Due Diligence teams, and Wealth Enterprises supporting financial advisors

- Customizable report generation

- Streamlined workflows for product sourcing and rigorous due diligence

- Curated fund lists to support advisor engagement and product education

- Generate custom fund suggestions and asset allocation recommendations based on your firm’s restrictions and viewpoints

- Multi-user collaboration with personalized training and usage insights

- Onboarding support, data integration, and a dedicated Client Success Manager