AI-powered intelligence for annuities

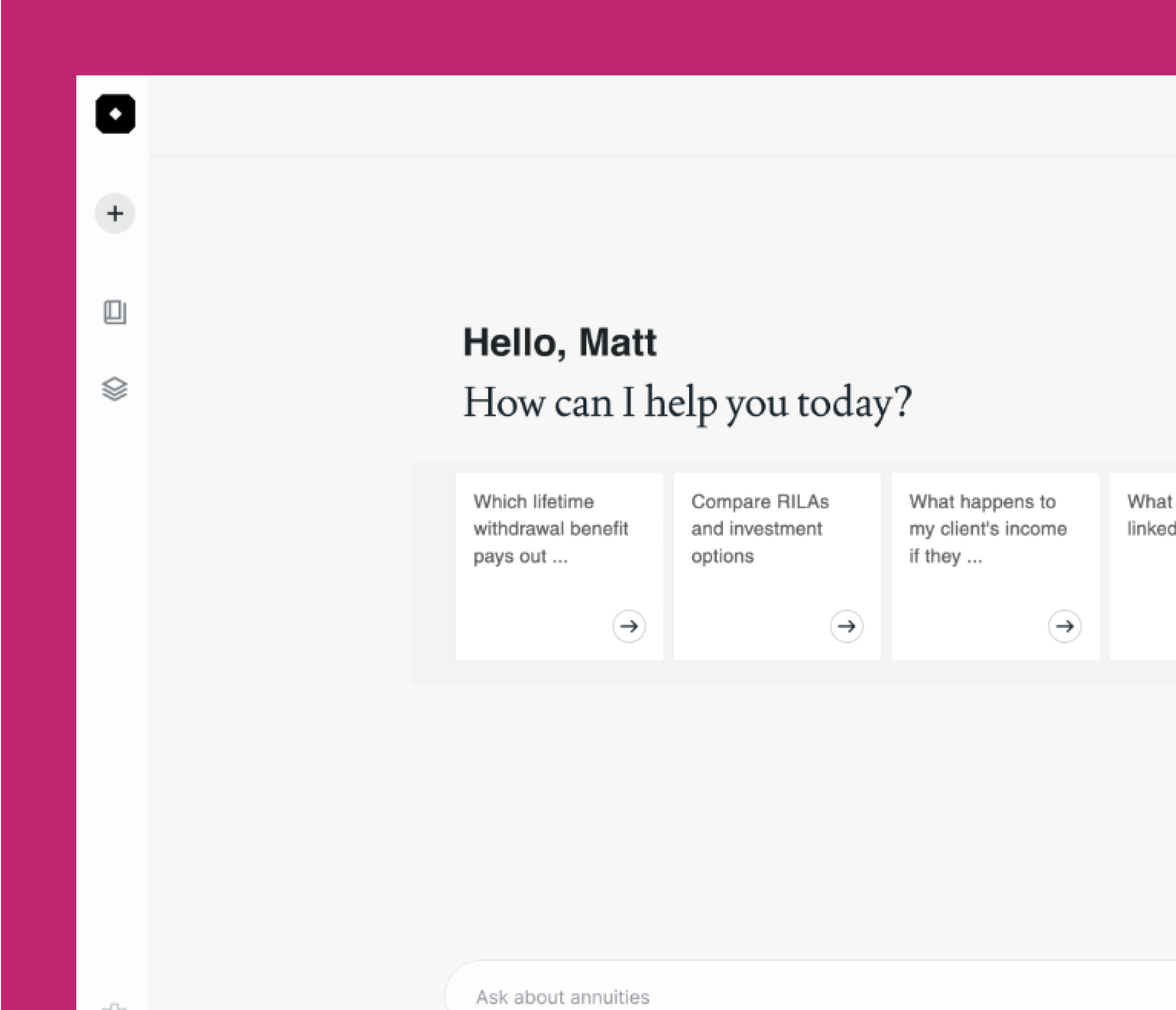

IP is a purpose-built service intelligence platform that integrates with your systems, understands context, and predicts what comes next.

What is IP?

IP sits on top of your policy data, giving service professionals instant, accurate, and compliant answers.

Everyone has AI. Only IP has intelligence.

IP drives accuracy, speed, and efficiency across the service desk. It’s more than just faster answers, IP proactively identifies risks, opportunities, and next steps, so service teams can deliver smarter guidance and a better advisor experience.

What is IP solving for?

The challenge today

Servicing existing annuity policies is becoming harder and more costly:

- Fragmented data across multiple systems

- Long call times and escalations that frustrate advisors

- Limited ability to anticipate retention risks during servicing conversations

- High training costs for new service reps

Meanwhile, annuities represent one of the largest untapped growth and retention opportunities in wealth and insurance—yet complexity and service friction limit adoption and trust.

The IP solution

Simplifying service. Building trust.

With IP, carriers can transform the service desk into a growth and retention engine:

- Instant clarity – unified, real-time access to policy data, riders, and benefits

- Proactive intelligence – AI surfaces “if this, then that” signals (expiring surrender charges, rider activations, retention risks)

- Compliant answers, every time – built-in guardrails and citations ensure accuracy

- Scalable efficiency – faster call resolution, fewer errors, and shorter training cycles for service reps

- Advisor confidence – service teams anticipate needs, resolve questions quickly, and strengthen relationships

Business impact

Lower cost-to-serve

Minutes saved per call scale to millions in savings

Faster onboarding

New reps get up to speed quickly with AI guidance

Improved retention

Early signals help carriers keep assets in-house

Stronger relationships

Advisors trust the carrier’s ability to deliver clarity and confidence at every interaction

Making annuities easier to own and service

Using AI to reduce friction and improve outcomes in annuity servicing.

In this video you’ll learn about:

- Why annuity servicing is broken—and how AI can fix it

- How predictive tools help insurance firms staff smarter and respond faster

- What makes TIFIN’s solution different: AI + deep domain expertise

How IP works

Connect to policy data

IP integrates securely with your policy and servicing systems, creating a single source of truth with real-time visibility.

AI-powered insights

Unlike basic retrieval models, IP is trained on your annuity policies. Its conversational AI interprets complex rules and riders to deliver accurate, compliant answers.

Proactive intelligence

IP goes beyond basic lookups, delivering real-time answers to scenario-based “what if” questions and proactively flagging next best actions.

Seamless delivery

Insights appear directly in the service workflow or CRM, and each interaction ends with an automatic summary, capturing context and next steps, so future calls never start from scratch.