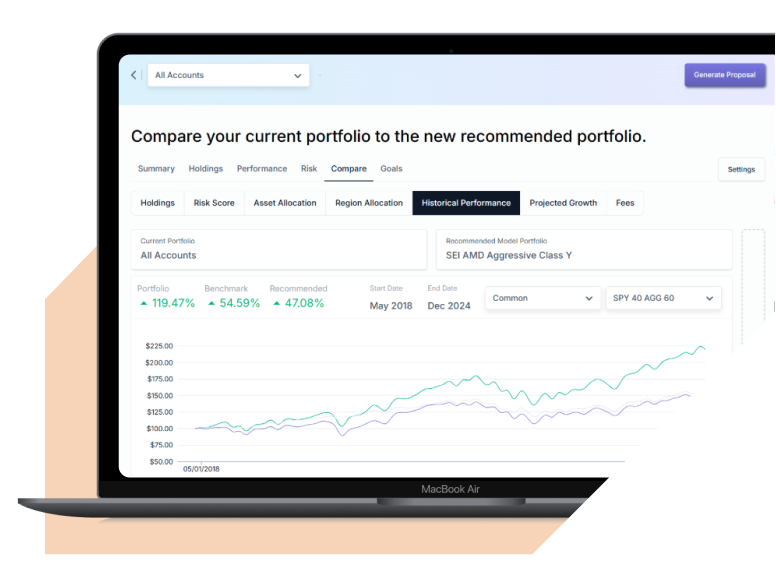

An easy way to generate investment proposals.

TIFIN Wealth is a cutting edge proposal generation platform that enhances financial advisory services by delivering personalized investment solutions. It helps advisors optimize portfolio recommendations, improve client engagement, and align investments with individual risk tolerance and financial goals.

Hyper-personalized insights at the click of a button.

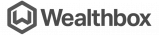

TIFIN Wealth aggregates data from multiple assessments to build a broad view into a prospect or client’s wants, fears, values, and appetite for risk.

Within minutes, advisors can generate personalized proposals designed to maximize returns while remaining within the client’s unique risk band.

The Wealth risk assessment goes beyond subjective, one-dimensional scoring to focus on fact-based risk tolerance. Our quantitative, multi-scoring approach takes into account risk preference, risk capacity and portfolio risk.

Retirement focused micro-planning capability for goals based proposals

Convert prospects by aligning portfolio risk within their unique Risk Band

Key functionality

Client-friendly Questionnaire

With 16 short questions, your clients can complete the survey in less than 5 minutes.

Facts-based risk scoring

Emphasis on Risk Capacity is less likely to waver with markets as does Risk Preference alone.

Conversion engine

Convert prospects faster by showing how their current portfolio is not within their “Risk Band.”

Micro-planning Goals

Conversational AI assessment for goals based proposals.

Compliance-friendly

Create unified proposals using risk and goals-driven inputs.

Archival capabilities

FINRA reviewed proposals designed to support Regulation Best Interest.

Experience Wealth today.

Tell us about your goals, and a knowledgeable representative will prepare a demo for you.

Questions?

TIFIN Wealth is an AI-powered platform that enhances financial advisory services by delivering personalized investment solutions. It helps advisors optimize portfolio recommendations, improve client engagement, and align investments with individual risk tolerance and financial goals.

TIFIN Wealth uses risk and retirement planning assessments to generate customized investment proposals in minutes. By analyzing client risk profiles, financial goals, and market data, the platform provides advisors with tailored, data-backed recommendations to enhance client outcomes.

TIFIN Wealth seamlessly integrates with leading CRM, custodial, and portfolio management platforms, including Fidelity, Schwab, CircleBlack, Orion, Black Diamond, and many others. These integrations enable advisors to streamline workflows, and enhance client servicing.

TIFIN Wealth’s Risk Alignment solution assesses an investors ability and willingness to take on risk. By matching model portfolios to client risk profiles, advisors can enhance client confidence, improve retention, and ensure investments align with financial objectives.

TIFIN Wealth is designed for financial advisors, RIAs, broker-dealers, and wealth enterprises looking for an easy-to-use, affordable, FINRA compliant investment proposal solution. The platform helps firms personalize investment strategies, automate proposal generation, and optimize client engagement.