We create technology to improve wealth outcomes.

With rising demand for financial advice, old delivery models are falling short. We’re bridging the gap with platforms at every rung of the wealth stack.

Platform products

Finally, data-driven fund flows

Fully informed investing

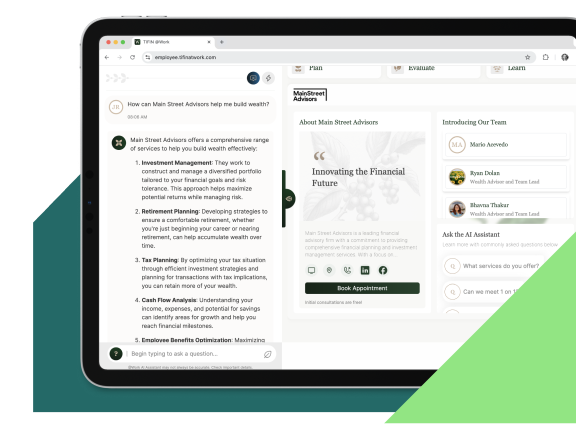

AI for wealth portfolios

The 1st workplace platform for advisor growth

For the rapidly growing Indian wealth ecosystem, investors and advisors look to localized AI support from MyFi™, RM™, and @WorkiFi™.

Rapid, repeatable innovation.

TIFIN Studios products directly address specific missing capabilities within important workflows, allowing us to bring transformative impact to market faster than traditional approaches.

Studios products

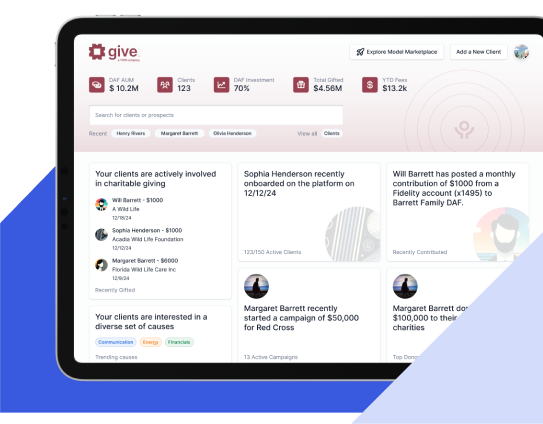

Philanthropy, made flexible

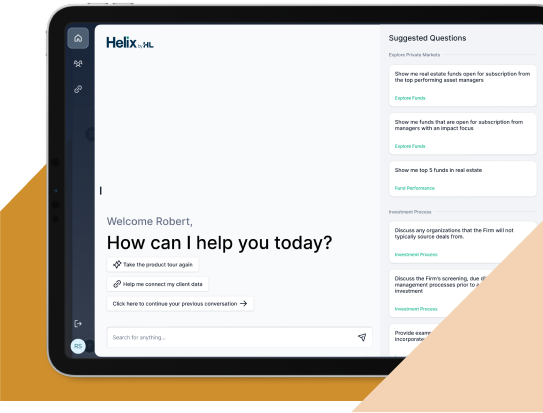

Private markets, unlocked

A track record of innovation

Questions?

TIFIN AI provides investors, advisors, wealth enterprises, asset managers, and insurance companies with the flexibility to apply technology in the ways that fit their needs best. For instance, an a advisor or advisory firm with clients ranging from workplace to families and individuals, may choose to employ Sage, Give, @Work. They may then find their clients have a need for support in the private markets space and choose to add Helix. Similarly, wealth firms looking to prioritize business growth may decide they want to add AG to use apply data science to identify existing and new clients ready to expand their relationships.

The best way to know if your company’s 401K or other retirement plan advisor can add @Work to your benefits portal is simply to ask. With the speed of technological adoption and typical nature of benefits cycles, a plan advisor may already offer TIFIN @Work to their clients, but is waiting for your annual enrollment period to inform you of the opportunity. Ask your advisor if they offer @Work for your company retirement plan. Don’t know who to contact? Ask us and we’ll get in touch with them for you.

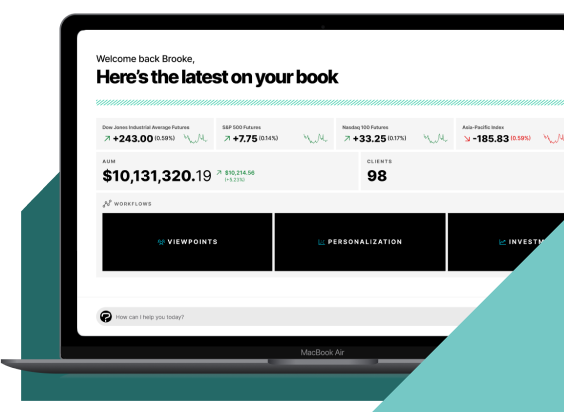

Advisors, wealth management firms, insurance firms, and asset managers looking to grow their business can use TIFIN AI data science to identify existing and new clients that are best fit for their business. First, firms will unify their data from which AG and AMP can derive intelligence and deliver the insights uncovered, including the prospect’s TIFIN Score. From there, advisors have access to guidance on outreach and engagement, and then can further refine and train on the insights provided. Financial professionals have found that existing clients with a top 25% TIFIN Score are over 16x more likely to expand their existing business, over 13x more likely to be retained, and new prospects are over 6x more likely to be acquired.