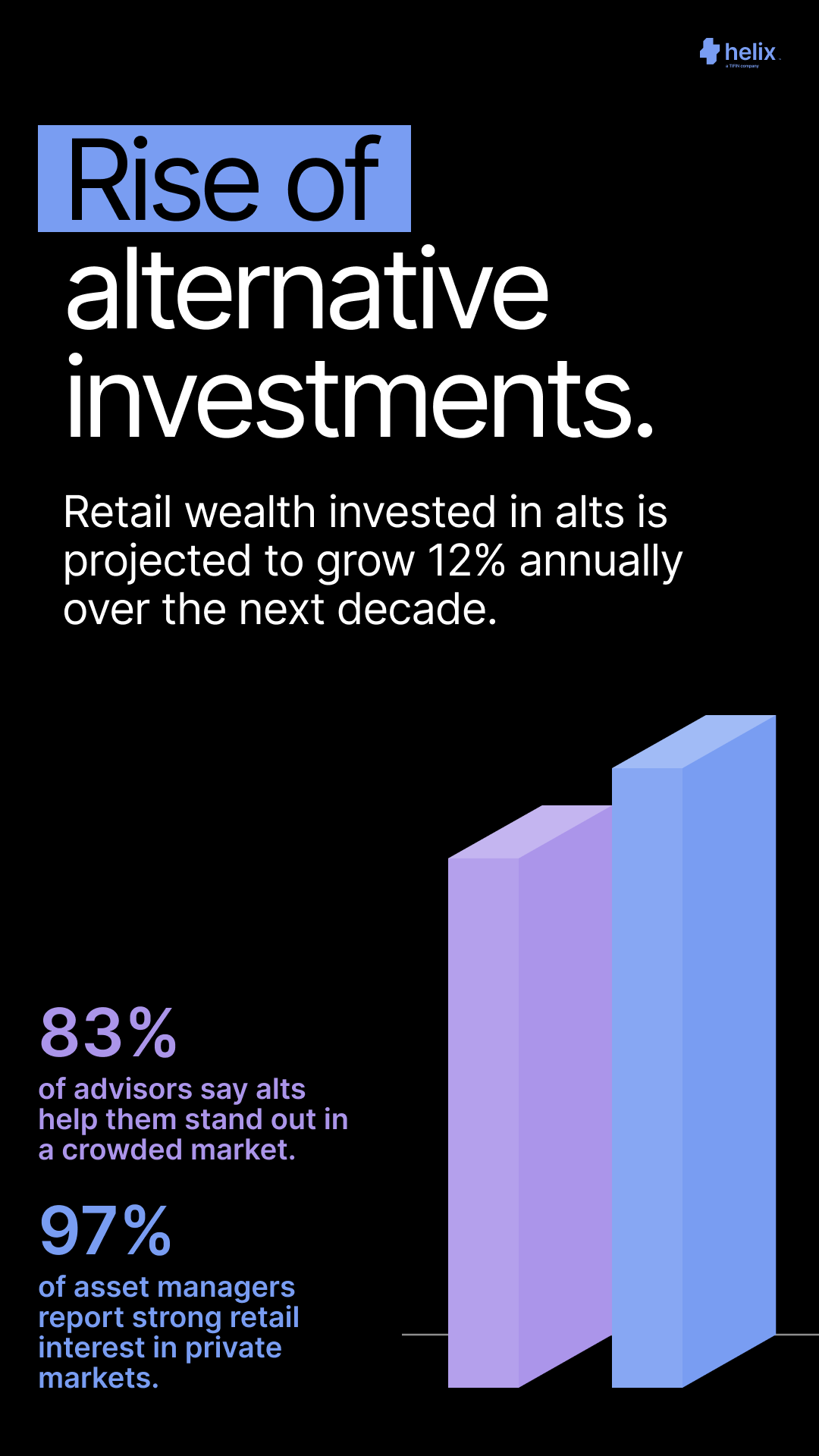

The landscape of alternative investments is rapidly evolving. Once considered a niche, private markets have become a cornerstone for diversification and enhanced returns. Retail wealth invested in alts is projected to grow 12% annually over the next decade, driven by investor demand for differentiated strategies and income-generating assets. According to a CAIS-Mercer study from December 2024, large asset owners are increasingly doubling down on private markets as they navigate heightened economic and geopolitical risks, underscoring the critical role that alternative investments play in today’s market landscape.

In fact, 83% of advisors report that alternative investments help them stand out in a crowded marketplace, while 59% believe they are key to attracting new clients. For asset managers, the interest is palpable—97% report strong or moderate retail interest in private markets. Yet, despite the growth potential, private markets remain underutilized by advisors. Why? The barriers to entry are significant. Access to data is fragmented, due diligence is labor-intensive, and navigating the complexities of private markets requires specialized expertise.

A New Era of Intelligence in Private Markets

Helix, a powerful AI-driven platform developed through a strategic partnership between TIFIN and Hamilton Lane, is redefining how wealth enterprises and advisors engage with private markets. By integrating vast datasets, advanced AI, and industry-leading insights, Helix simplifies the complex processes of product sourcing, due diligence, and fund analysis—empowering firms to make smarter, faster decisions.

For Steve Snyder, COO of Helix, the mission is clear: “Advisors and investment teams need more than data—they need context, actionable insights, and a way to align their strategies across the enterprise. That’s where Helix comes in, transforming complex datasets into clear, actionable intelligence that drives better outcomes for firms and their clients.”

Why Now? For large RIAs, family offices, and wealth platforms, the need to bridge the gap between advisor insights and firm-level strategy has never been more urgent. Helix addresses this by creating a unified framework for collaboration, compliance, and product management. Through Helix Pro, firms can oversee advisor engagement, align investment recommendations with firm strategies, and track fund interest across teams—all while maintaining regulatory compliance.

Meanwhile, individual advisors using Helix RIA gain a cost-effective entry point to powerful private markets data, enabling them to confidently present diversified investment strategies to their clients.

The Bottom Line: A Smarter Path to Private Markets

Private markets are no longer just an “alternative.” They are becoming essential components of modern portfolios. Helix is positioned to lead this evolution, offering wealth firms a streamlined, intelligent approach to private markets that maximizes advisor effectiveness and firm-wide impact.

For more information on how Helix can transform your firm’s approach to private markets, schedule a demo today.