3 Ways Advisors Can Reset and Reinvigorate in the New Year

The Greatest Asset: Mastering Your Practice with Thomas Droge At TIFIN Wealth, our “why” is solving for any challenge advisors may experience in their practices and creating solutions to help you grow your business. In our The Greatest Asset series, TIFIN’s Chief Mindfulness Officer Thomas Droge shares how advisors can implement strategies to maximize their […]

Prospecting with NexGen Technologies for Financial Advisors

To succeed as a financial advisor, you need a strong client base – and that takes time and effort to build and maintain. In fact, research suggests it takes an average of eight touch points to convert a prospect into a sale – making it a particularly arduous process. Fortunately, thanks to advances in technology, prospecting isn’t […]

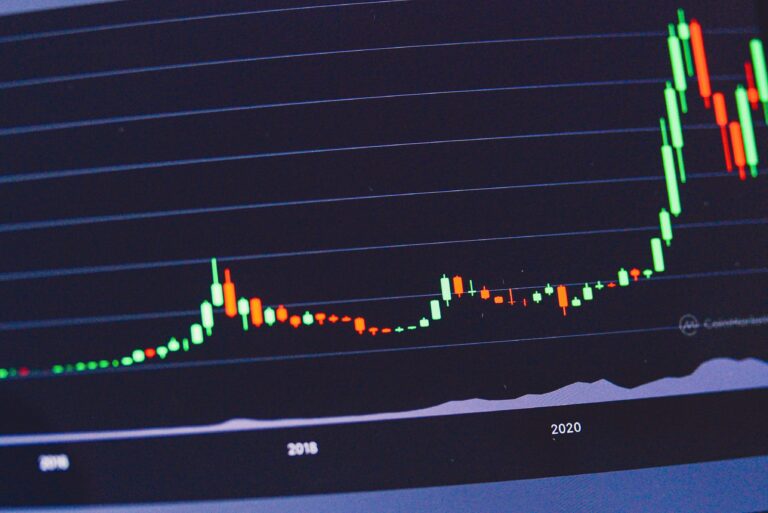

Powering Through the Small Cap Bear Market, Expecting Strong Fundamentals to Ultimately Prevail

From Calamos: “A valuation re-rating lower without a lot of teeth behind it.”

A Multi-Year Value Cycle Beckons

From Wisdom Tree: It’s possible a new value cycle commenced in November 2021, reversing 14 years of woeful underperformance relative to growth.

The Investment Case for Corporate Diversity

From Calamos: If you’d like a long, involved explanation of how Calamos Phineus Long/Short Fund (CPLIX) contributes to a portfolio, we’re happy to oblige.

Can Your Long/Short Fund Do This? 3 Ways CPLIX Can Make a Difference in a Portfolio

From Calamos: If you’d like a long, involved explanation of how CPLIX contributes to a portfolio, we’re happy to oblige.

The Inflationary Shock of the Russia-Ukraine Crisis

From Franklin Templeton: Russia’s invasion of Ukraine has already caused a tragic human toll. It also brings yet another disruptive shock to a global economy.

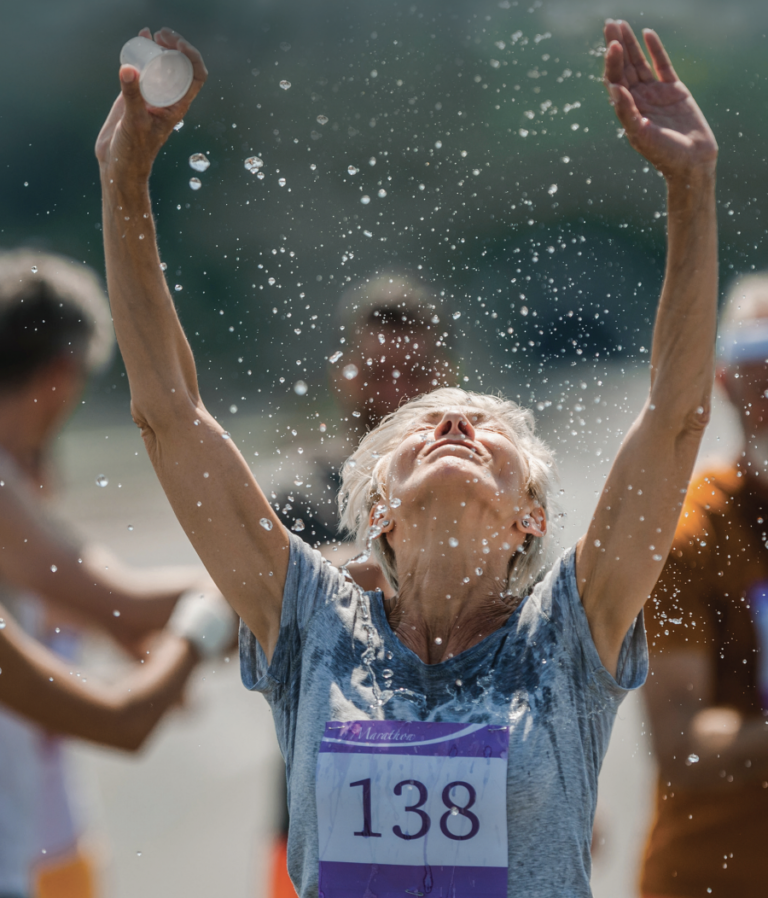

7 Things to Do in the Decade Before Retirement

From Franklin Templeton: Like a runner in a long-distance race, you’ve worked hard over many years to prepare for retirement.

Magnifi Survey Finds More Than Half of Americans Not on Track to Achieve Financial Goals This Year

Magnifi shares five year-end tips to help Americans make the most of their investments.

Accessing Real Estate Exposure Through Private Credit

In times of market volatility, some investors look toward real estate as a safe haven for their capital as well as protection against inflation. Owning real estate has many potential benefits, however, not all investors have the financial flexibility to have their money locked up for 10-plus years. Private credit offers these investors exposure to […]