[Case Study] How TIFIN Content Advisors Are Using Personalized Outreach To Convert New Clients

From digital marketing to content marketing to social selling; advisors these days are bombarded with buzzwords, best-practice tips, and lists of tactics you should try for your firm. However, rarely do these articles walk through a specific journey of how an advisor can turn these theoretical concepts into practical actions that generate ROI. In this […]

Personalize or Perish: Why Personalization is Key for Financial Advisors

Personalization is key to compete in a crowded marketplace. While personalization was once a “nice to have,” providing a personalized wealth management has become essential to remaining relevant in a competitive marketplace where clients expect more than ever. For financial advisors, the stakes are even higher. As investors are increasingly turning to new robo technology […]

8 Tips For Financial Advisors To Level Up Their Social Media

It’s no longer news that social media is a vastly powerful force in marketing. More than 73% of marketing professionals said that social media marketing was either “very effective” or “somewhat effective” in a 2019 Buffer study. And social media marketing is an increasingly important part of a strong financial marketing campaign as well, partially […]

Why not having the right API strategy is not just a poor business decision, it is a client retention issue for fintechs

The Era Of Walled SaaS Gardens Is Dead Not too long ago, software platforms could live in isolation. They were built as complete waterfall technologies that served specific broad sets of needs for their clientele. Rarely, did these platforms have a need to cross-pollinate or connect with parallel or competing technologies. Then as services fragmented, […]

How Today’s Portfolio Risk Assessment Tools Rely On AI and Big Data To Better Serve Their Clients

Traditionally, advisors were only able to capture inputs directly from their clients. This information was often very subjective and relied heavily on the clients’ feelings about investing and risk. Fact-based questions were often limited to a small set of questions, such as time horizon and availability of assets. Even still, these “facts” were vulnerable to […]

Why Today’s Modern Advisor Needs Their Online Risk Tolerance Questionnaire To Be Part of an Integrated Fintech Platform

Gone are the days a risk assessment should be conducted on paper or in a spreadsheet. These processes are cumbersome, slow, and prone to inaccuracies. Recognizing these problems, the founders of TIFIN Risk spent over five years creating a tool that integrates with leading broker-dealers and custodians, as well as complimentary fintech partners. We focused […]

How the Right Risk Profiling Can Help You Close Clients (No, Really!)

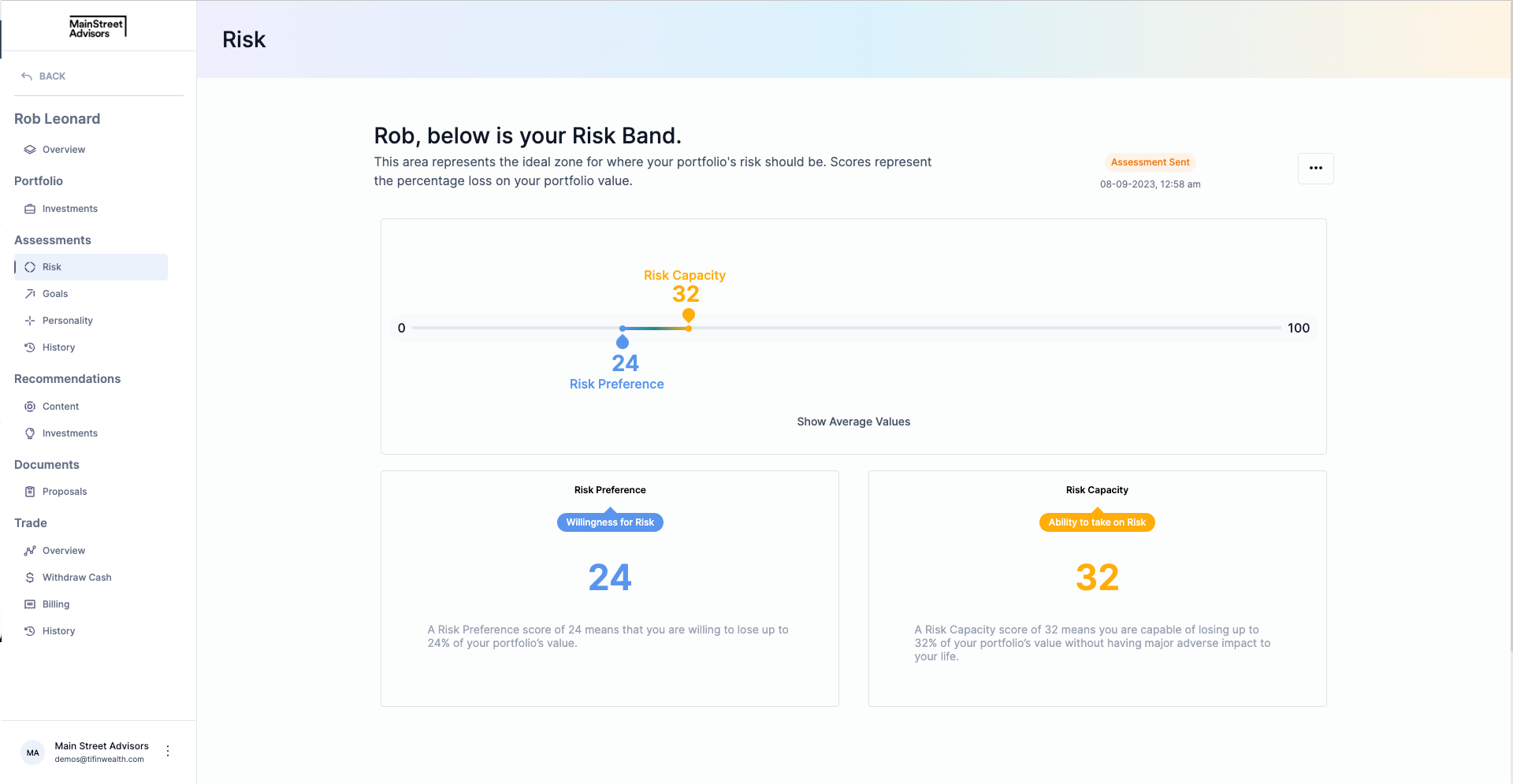

As discussed in our article Traditional Risk Tolerance Questionnaires Lead to Inaccurate Risk Appetite, risk tolerance questionnaires help mitigate biases and emotional subjectivity in investing decisions. But risk profiling through TIFIN Wealth’s Risk Alignment tool takes it a step further. Unlike other questionnaires that only provide one aspect of risk at a time, our platform […]

If You’re Only Looking at Traditional Risk Tolerance, You’re Missing More Than Half of the Equation

At TIFIN Wealth Risk Alignment, we’ve introduced a better way to quantify risk. The usual risk tolerance questionnaire for advisor includes questions about how your client feels about money and investing. This score has traditionally been the predominant, if not the sole, factor in creating a portfolio for clients. This risk tolerance methodology was a […]

Why Traditional Risk Tolerance Questionnaires Lead to Inaccurate Risk Appetite

As an advisor, you have probably been relying on financial risk tolerance questionnaires to assess a client’s risk preference. Then, depending on the client’s answers, you gear the portfolio to a more or less aggressive approach. The problem with this method is that the questions weigh heavily on how a client generally feels about investing […]

How Positive Psychology Is Moving From The Fitness Industry To Financial Services

What can the financial services industry learn about loyalty and engagement from the world of fitness? More than you might expect. The fitness industry, specifically brands like Peloton and Noom, have embraced the principles of positive psychology to change the way people approach working out and weight loss. Instead of considering fitness a means to […]