From Data to Decisions: AI’s Role in Portfolio Management

On Smarter Planner, Brooke Juniper, CEO of Sage, explores AI’s evolution in wealth advisory, from quant strategies to generative AI’s role in portfolio personalization and qualitative research.

Bridging the Gap Between Retirement Planning and Wealth Management

In today’s financial landscape, employees are seeking more from their workplace benefits, especially regarding retirement planning. However, many employees face a disconnect between their workplace benefits and overall financial goals. Enter TIFIN @Work, a platform that bridges this gap by offering personalized, AI-driven financial advice tailored to each employee’s unique circumstances.

Driving Multi-Generational Engagement and Retention Through Philanthropy

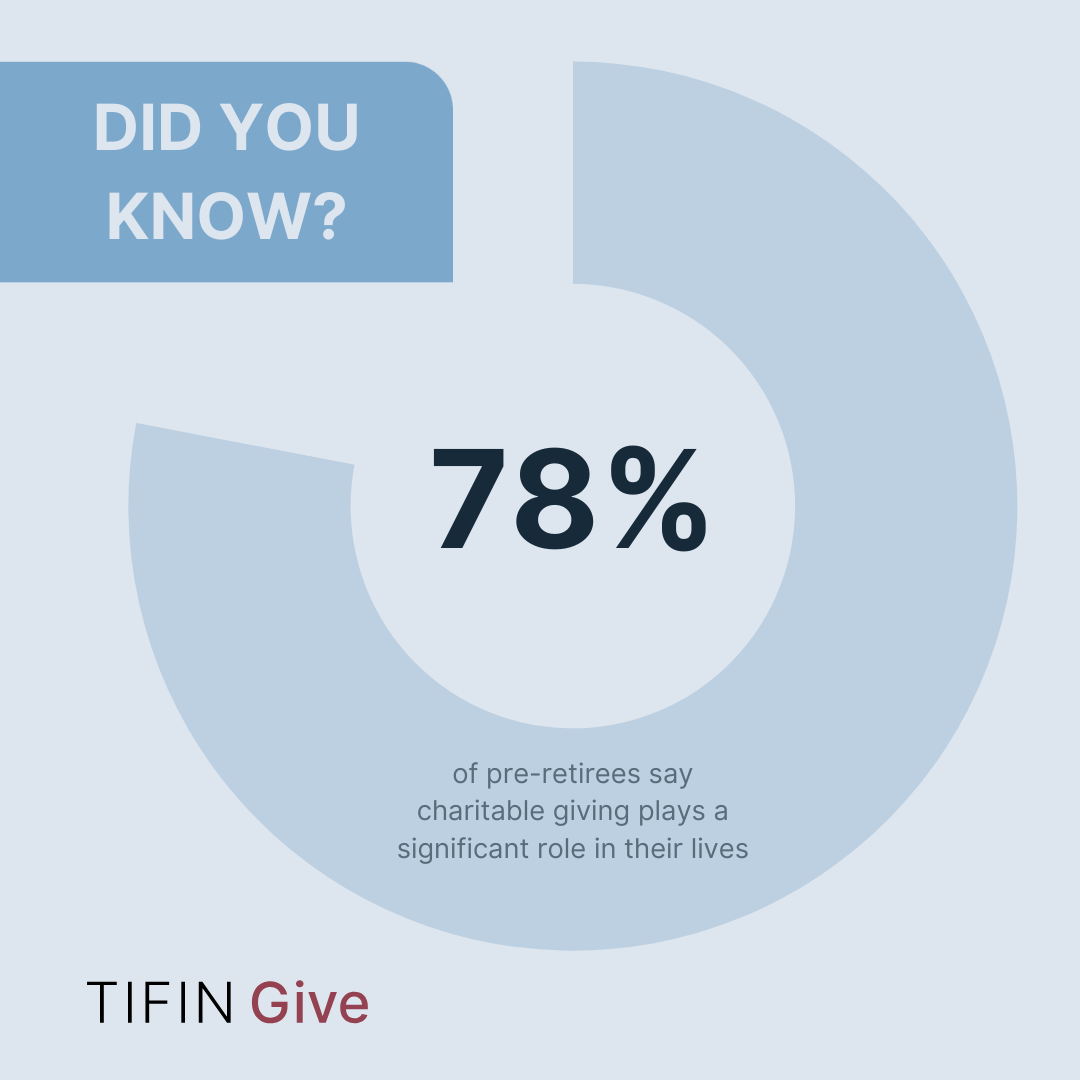

Advisors currently face the challenge of not only serving clients but also ensuring long-term acquisition and retention as wealth transfers across generations. One highly effective strategy to foster engagement and retention is through philanthropy. By incorporating charitable giving into wealth management, advisors can create deeper, multi-generational connections that resonate across families, fostering both loyalty and long-term engagement.

Key Takeaways from ADISA 2024

At the ADISA 2024 Annual Conference & Trade Show in Las Vegas, the excitement around Helix was palpable! Advisors expressed a growing demand for efficient evaluation tools to navigate the complex landscape of alternative investments.

Organic Growth

“What you’ve been doing to grow your business may not work in today’s market. It’s time to leverage innovation.” Jeannette Kuda, President and CEO, TIFIN AG

Is Financial Stress Holding Your Workforce Back? How AI Can Help Improve Benefits Utilization

Did you know that financial stress is now a top concern for 73% of employees? Surprisingly, many feel overwhelmed by the variety of voluntary benefits offered, leading to underutilization. Nearly 40% report feeling uninformed about their non-medical benefits, missing out on valuable resources that could alleviate their financial worries. TIFIN @Work is here to change that.

Community, Connection, & Innovation – Reflecting on TIFIN Ideas day

In this white paper, TIFIN President & CRO Rob Pettman applies his first-hand perspective on what wealth management firms need to consider when examining the impact of new AI technologies. Rob delves into some critical considerations for successfully evaluating and integrating AI technology into an advisory firm.

Redefining Retirement: How Advisors Can Support the Charitable Giving Goals of Today’s Retirees

As Baby Boomers enter retirement, their approach to charitable giving is transforming the philanthropic landscape. This trend reveals both an opportunity and a responsibility for financial advisors to provide guidance that aligns with their clients’ evolving priorities.

Private Markets in 2024: What’s Driving Investor Interest and How Advisors Can Capitalize

Private markets are on the rise in 2024, offering the potential for higher returns and diversification opportunities. As investors seek exclusive investments in sectors like private equity and real estate, financial advisors must adapt to meet this demand. However, incorporating private markets comes with challenges such as time-consuming due diligence and educating clients about risks. To stay competitive, advisors can leverage AI-driven platforms like Helix to streamline processes and offer real-time market insights.

Why Every Retirement Plan Advisor Needs TIFIN @Work in Their Toolkit: A Step-by-Step Guide to Maximizing Workplace Opportunities

Are you ready to revolutionize how you engage with clients in the workplace? Discover how TIFIN @Work can transform your approach, offering personalized guidance, AI-driven insights, and seamless integration. Take the next step in growing your retirement advisory practice and maximizing your potential.