Growth, solved differently.

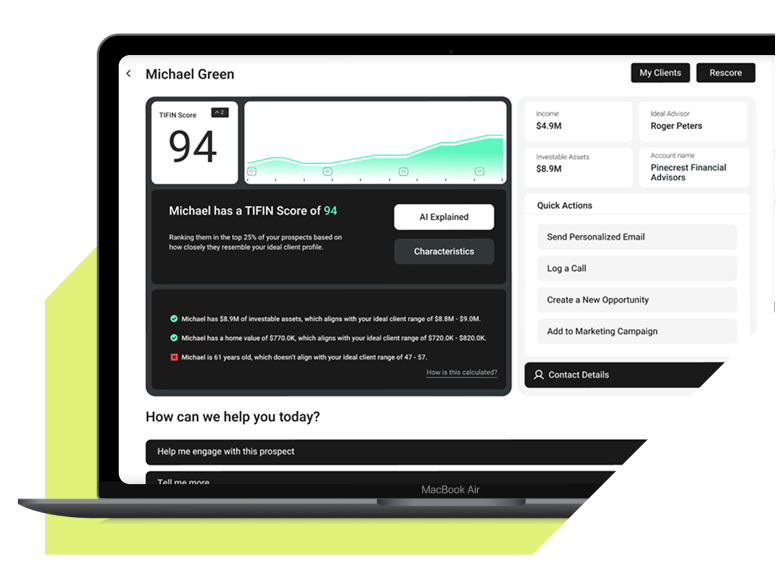

TIFIN AG™ delivers data-driven intelligence to help wealth managers grow through expansion, retention, and acquisition.

70% of wealth management firms struggle with consistent growth.

As traditional strategies fail to capture new assets or retain clients, firms are left without the insights needed for long-term success. Our data-driven insights empower wealth managers to focus on key opportunities, ensuring scalable success and a long-term competitive advantage.

Expansion

For uncovering growth opportunities within your current client base, prospects ranked in the Top 25% of TIFIN Scores are 16.8x more likely to consolidate their assets than clients with lower scores.

Retention

For identifiying behaviors of at-risk clients to retain and grow their assets, prospects ranked in the Top 25% of TIFIN Scores are 13.1x more likely to be at-risk of large distributions than clients with lower scores.

Acquisition

For improving your client conversion process, prospects ranked in the Top 25% of TIFIN Scores are 6.1x more likely to become clients compared to prospects with lower scores.

Intelligent growth, proven results.

Advisors often ask

How our AI Growth Engine works

Unify and enrich

Integrate and enhance data from multiple sources.

Derive intelligence

Apply AI/ML models to generate actionable insights.

Deliver insights

Seamlessly add insights into advisor desktops and CRM platforms.

Experience AG today.

Thinking about adding AI-powered intelligence to your growth plan?

Tell us about your goals, and a knowledgeable representative will prepare a demo for you.

*Required field

Questions?

TIFIN AG employs supervised AI and machine learning algorithms to analyze advisor and client behaviors, delivering actionable insights that help wealth managers identify growth opportunities, retain clients, and acquire new ones.

Many wealth management firms struggle with inconsistent asset growth and outdated strategies. TIFIN AG’s AI-driven solutions provide data-driven insights, enabling firms to focus on key opportunities, enhance client retention, and achieve scalable success.

AI can flag behaviors indicative of at-risk clients, allowing advisors to proactively engage and address potential issues before they lead to asset outflows.

Clients utilizing TIFIN AG’s Expansion, Retention, and Acquisition models have seen a 4.5% net increase in Assets Under Management (AUM) and achieved growth goals in half the expected time.

The AI analyzes client data to uncover patterns and trends, highlighting clients likely to consolidate assets or those presenting cross-selling opportunities, thus facilitating organic growth.

TIFIN AG combines extensive industry experience with advanced AI technology, offering personalized insights and an outsourced data science team to deliver fast, efficient growth solutions tailored to each firm’s needs.