AI has arrived for workplace advisors.

TIFIN @Work™ is the world’s first AI financial assistant for the workplace.

How it works

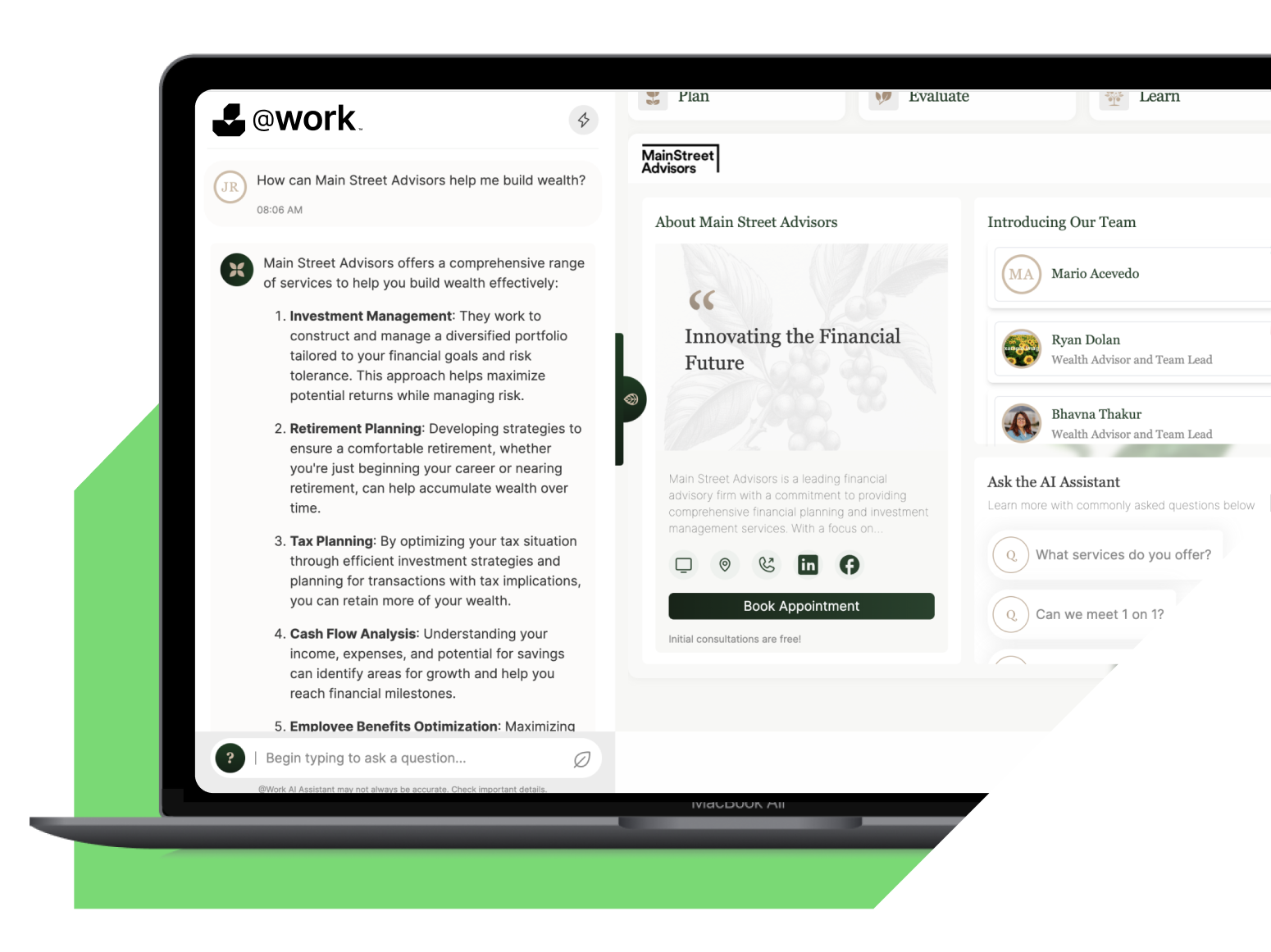

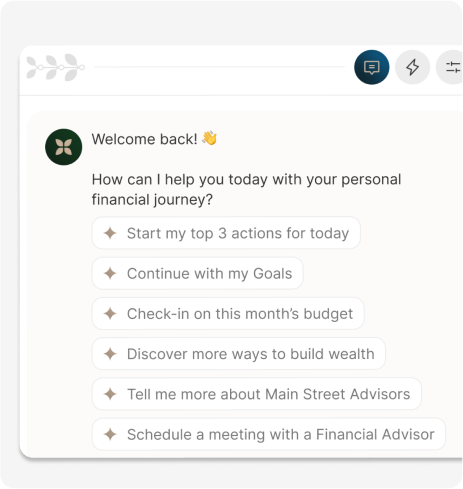

@Work empowers individuals to take charge of their financial future with personalized insights and actionable recommendations.

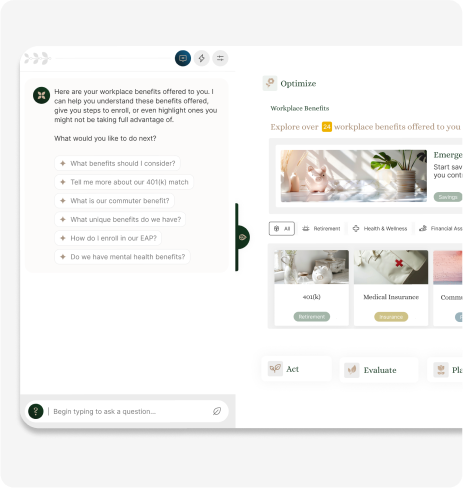

Using our AI-driven tools, users can discover tailored strategies for optimizing their paycheck, confident investing, intelligent budgeting, and effective benefits utilization.

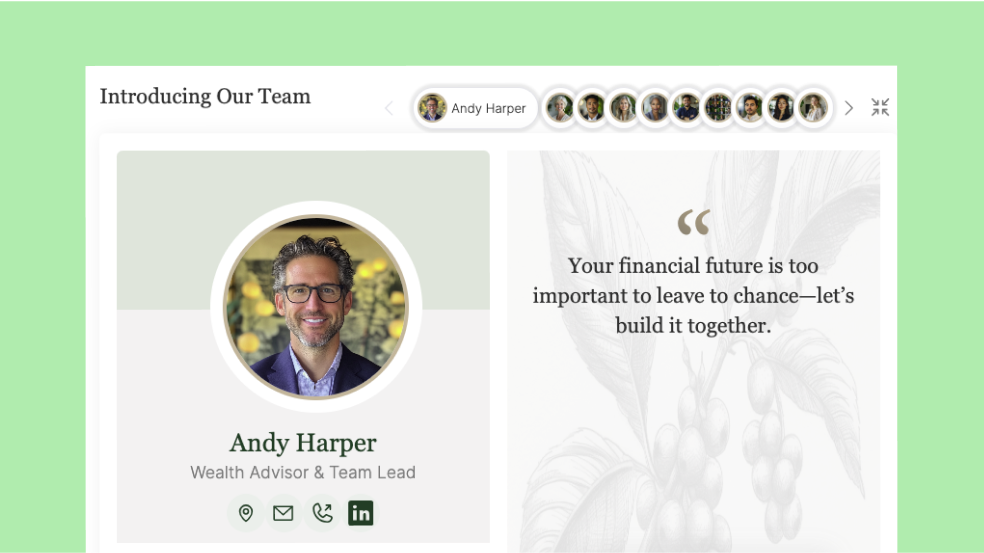

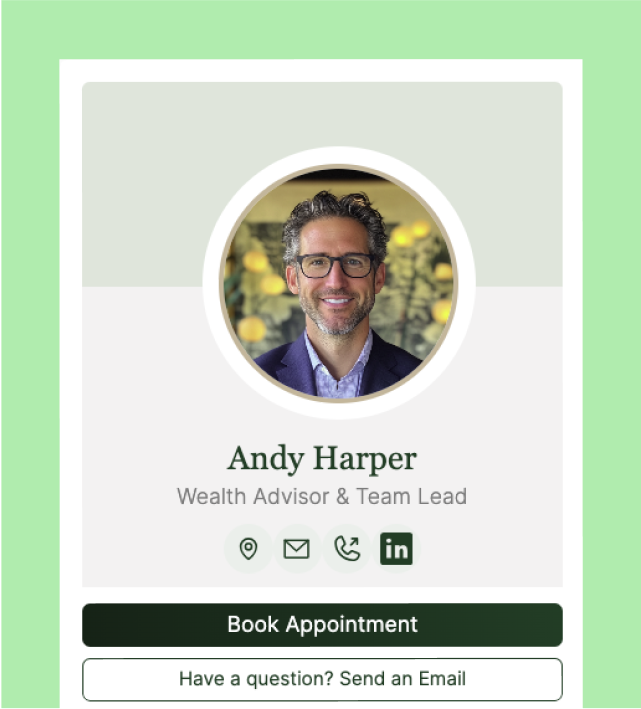

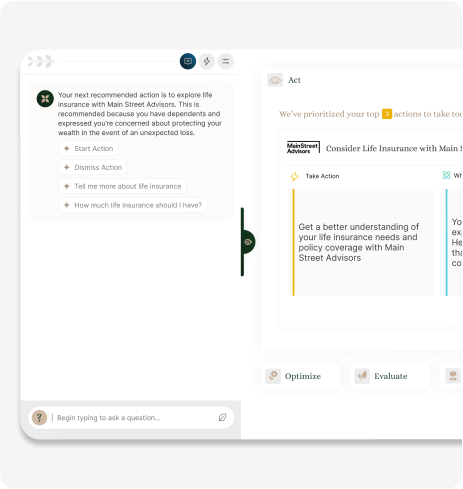

As their needs grow, we seamlessly connect participants with advisors to discuss how you can support their evolving goals.

Cutting-edge AI scales your services, helping grow your business with satisfied employers and engaged employees.

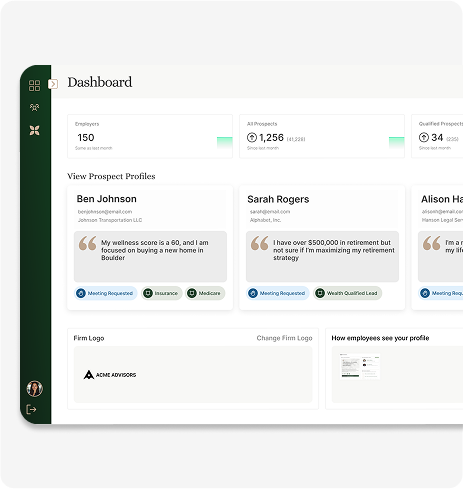

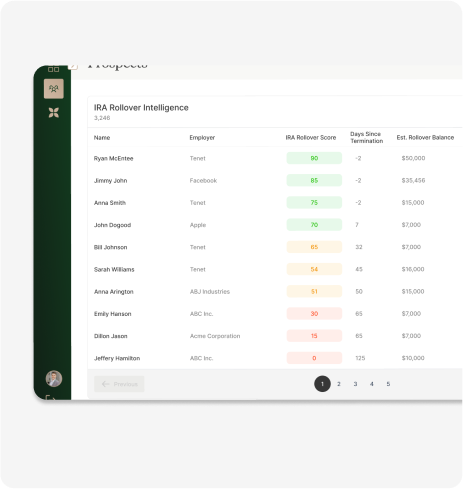

The platform identifies high-value participants ready for wealth management, providing a direct pathway to convert them into advised accounts in your AUM.

Actionable engagement analytics help you better understand participant needs, so you can tailor your advice and identify new opportunities.

No matter the size of the plan, every participant receives 1:1 guidance by engaging with their AI assistant — with advanced personalization from rich data integrations.

The AI assistant answers participants’ financial and benefits questions 24/7, reducing your workload and freeing up your time to focus on strategic client interactions.

Promote each of your firm’s services, including wealth management, insurance, and partner programs, at the right time for each employee’s needs.

It starts with always-on benefits support and ends with financial confidence.

With support for over 200+ HRIS integrations, employers can seamlessly connect payroll and benefits to answer any employee’s questions on-demand.

With resources, tools, and connectivity to 12,000+ institutions the AI adjusts to each employee’s goals at any stage of their financial journey.

Interactive financial health tools, personalized alerts, and insights across their full financial profile empower each employee to take control of their future.

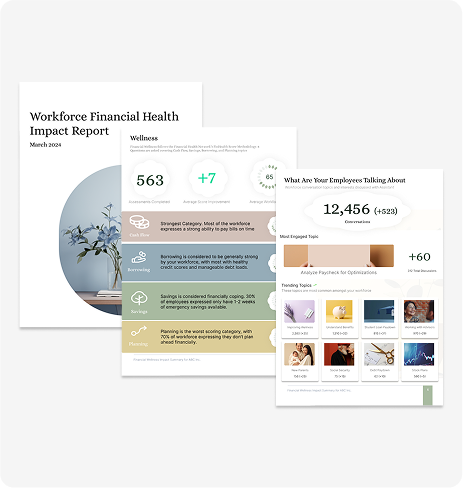

Next-gen engagement reporting provides advanced insights into trending topics, impact, goals, and aggregate health across the workforce.

The system identifies and alerts employees of under-utilized benefits or opportunities, based on connected spending habits, goals, and more.

Add AI to your toolbox

Financial advice is no longer just about numbers—it’s about delivering a personalized, responsive experience that helps clients achieve their goals and actually engages participants.

With TIFIN @Work, you can combine your expertise with cutting-edge AI tools. Together, you can stand out in today’s competitive landscape with next-level service for the next generation of clients.

Want to learn more? Our team is here to help.

*Required field

Questions?

TIFIN @Work provides advisors with intelligent data insights, personalized financial guidance for employees, and automated client engagement tools. This allows advisors to identify high-value prospects, increase plan participation, and seamlessly transition retirement plan participants into wealth management clients when they’re ready for professional help.

@Work leverages Gen-AI and data insights to transform retirement plans into wealth opportunities — serving up the right solution at the right moment for retirement plan advisors. That includes solving the common problems of lack of access to data, the highly competitive environment, difficulty providing personalization at scale, as well as new monetization opportunities.

Yes, TIFIN @Work integrates with leading retirement plan recordkeepers and financial institutions, making it easy for advisors to incorporate its AI-driven financial guidance into their existing workflow. This seamless integration ensures advisors can provide a personalized and scalable financial experience to employees.

Retirement plan advisors using TIFIN @Work gain a competitive edge by offering personalized AI-driven financial guidance that helps plan participants make smarter financial decisions. This engagement drives higher plan participation rates, strengthens client relationships, and creates opportunities for long-term wealth management services.

Advisors can request a demo or speak with a TIFIN @Work representative to explore how the platform can fit their specific business needs. Submit the contact form on this page to get in touch with a representative today and get a deeper understanding of how TIFIN @Work can help you with your specific goals.