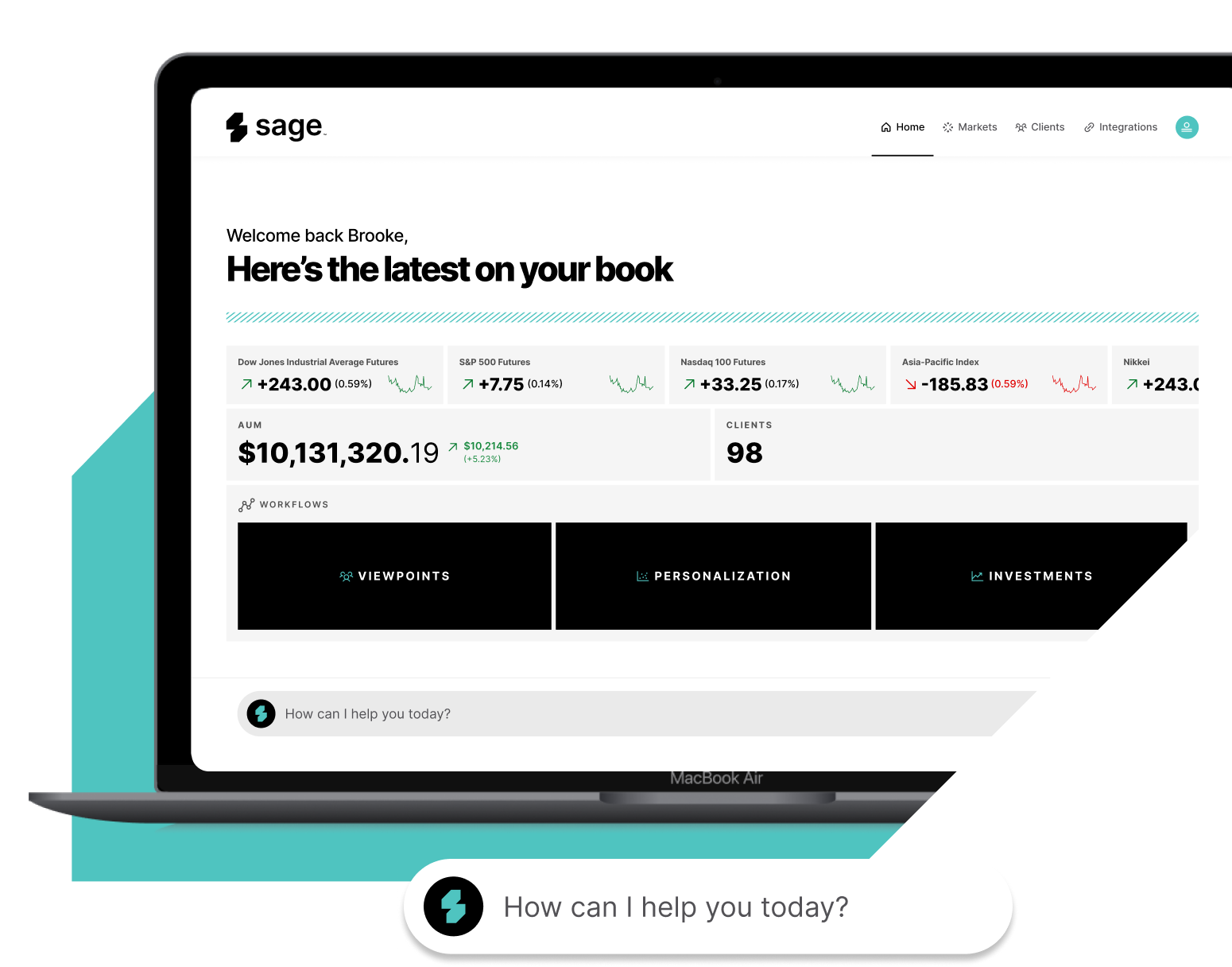

AI is here for wealth portfolios.

Sage streamlines the investment workflow within constraints of firm philosophy and CIO viewpoints.

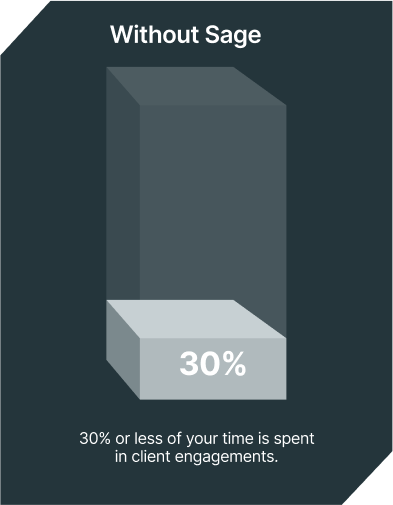

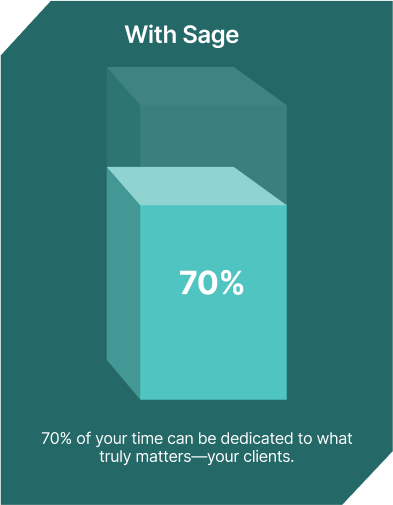

Now you can maximize client engagement.

AI precision drives wealth management excellence:

Streamline your workload, freeing up time to grow your business.

Deliver more personalized and responsive service to your clients.

Ensure your strategies are applied uniformly across all client accounts.

Manage a growing number of clients without sacrificing quality or personalization.

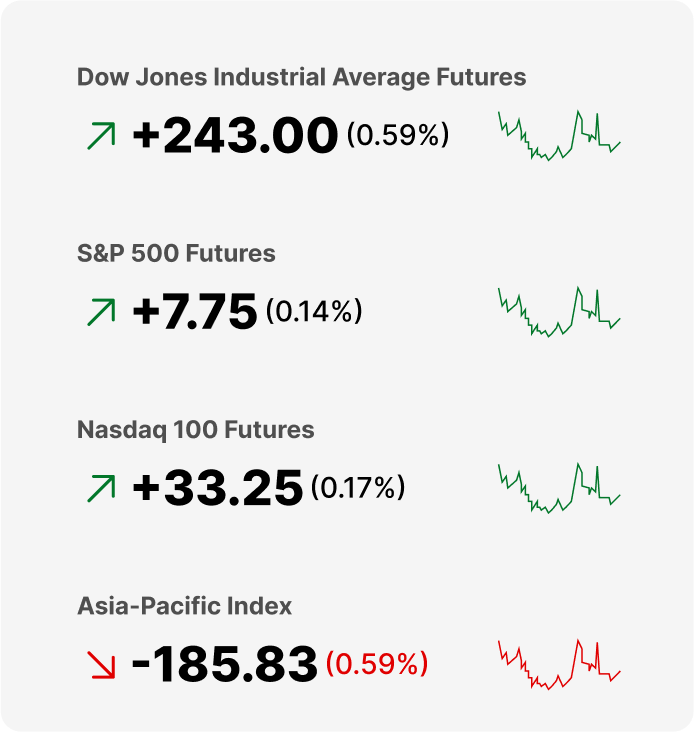

Make faster, data-driven decisions that lead to better outcomes.

Built on industry leading security.

AI-Driven Platform

Designed to process data in a secure and compliant manner, ensuring the privacy and confidentiality of user information.

Data Encryption and Secure Storage

The platform employs encryption to protect sensitive financial data both at rest and in transit.

Privacy by Design

TIFIN integrates privacy features directly into the design of its platform, ensuring that user data is handled with the utmost care from the moment it is collected.

Continuous Monitoring and Updates

The platform undergoes regular updates to enhance its security features and protect against emerging threats.

Experience TIFIN Sage™ today.

Sage empowers you to focus on scaling your business by streamlining portfolio management and client engagement.

Questions?

While Sage uses holistic data aggregation across multiple client portfolios and accounts for accurate investment insights, the platform also includes fully compliant customizable permissioning from client-specific to full-book-of-business recommendations.

Sage leverages TIFIN’s proprietary technology, rooted in our expertise in crafting generative AI-based workflows. By integrating with your existing portfolio management tools along with ongoing top of house, CIO, and third party strategies. For advisors, Sage unites previously disparate research and investment tools with client portfolios, unlocking a total book of business view.

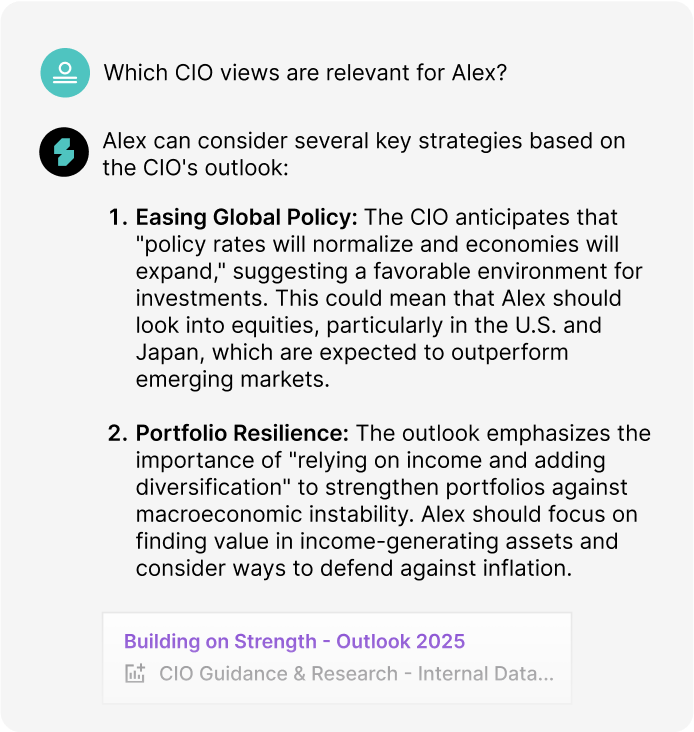

Sage acts as an AI investing assistant for advisors and research teams from CIO outlooks to individual client personalization. Some of the more popular types of assistance include: Model Construction & Adjustment, Model Matching & Proposals, and Client Meeting Prep.

Some ways an advisor might work with Sage around model matching and proposals include asking for help with tasks such as:

- Preparing a risk assessment for a client

- Suggesting a model portfolio for a client with specific risk, cost, or exposure preferences

- Comparing the performance, asset allocation, or risk of a model to a client’s portfolio

These are just some of the ways Sage can help with model matching and proposals.

Here are some examples of how an advisor might work with Sage to make client meeting prep more efficient or effective:

- Understanding how much exposure does a client’s portfolio has to a security or sector

- Reviewing what the main contributors to a client’s performance have been YTD

- Understanding how a client’s portfolio impacted by a particular market movement

- Looking up which CIO viewpoints support or challenge the client’s portfolio

- Seeing how a particular model portfolio is currently positioned or performed in the past