Countering Client Anxiety With Risk Scores Rooted in Reality

Market volatility is par for the course in investing—yet it can still catch your clients off guard. When markets dip or volatility prevails, investors often let their emotions rule, sparking feelings of anxiety (and even panic). This can lead to a premature sell-off, which can drastically reduce their returns in the long run. Case in […]

The Dangers of Gamified and Thrill-Seeking Investing for Gen Z and Millennials

Investing has always come with some risk, and it’s understood in the financial community that the more risk a person takes on, the more they may expose themselves to both big gains, but also big losses. Today, with national news headlines of the occasional meme stock trader, NFT connoisseur, or cryptocurrency investor making six figures […]

The Importance of Understanding Your Risk Profile for Your Retirement Accounts

With pensions nearing extinction, most Americans have had few other options but to build their own retirement nest eggs. Many individuals have turned to their 401(k) or IRA, to build up funds, hoping it will be enough down the line when they finally stop earning an income. If you have a good portion of your […]

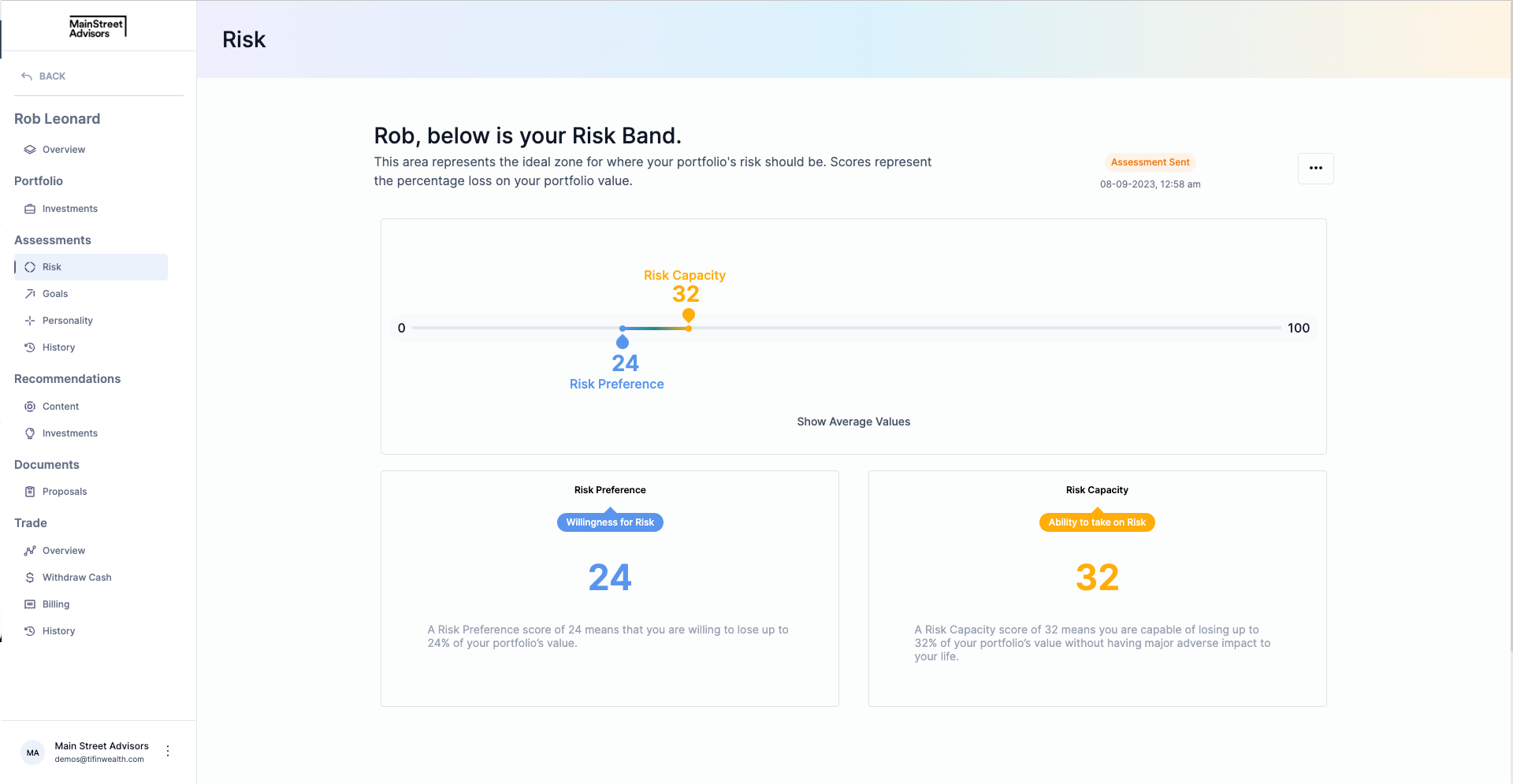

Why Risk Preference and Risk Capacity Need to Be Scored Separately

Risk tolerance questionnaires have traditionally consisted of questions that produce one score centered around risk preference or attitude, which advisors then use to create portfolios or record the rationale for how they match clients to specific firm models. This can often create misalignment as it may not expose the entire reality of an individual’s overall […]

TIFIN Risk is now an approved affinity partner for Infinex Financial Group

Today, we are excited to announce our latest partnership with Infinex Financial Group. TIFIN Risk is now an approved affinity partner, and we are able to offer our fact-based risk profiling platform to Infinex financial professionals at a discount. Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC. Schedule a […]

TIFIN Wealth is now integrated with Wealthbox CRM

TIFIN Wealth’s fact-based risk profiling platform is now even easier to use for advisors who work with Wealthbox CRM. We are excited to announce our joint users can now import their Wealthbox contacts into TIFIN Wealth to quickly send them questionnaires and better maintain the risk scores in their investment portfolios. Schedule a demo to learn […]

How the combination of TIFIN Risk + CircleBlack helps advisors drive fact-based financial wellness.

In this episode of TIFIN Risk LIVE, Sarah Rasmuss, Chief Product Officer at Circle Black, and Larry Shumbres, Co-Founder and Chief Revenue Officer at TIFIN Risk go through an overview of both platforms and how the combination can help advisors drive fact-based financial wellness. https://www.youtube.com/watch?v=OlAxthQIqj0

Why Fact-Based Multidimensional Risk Capacity Is a Superior Approach for Financial Advisors to Profile Their Clients

Advisors have traditionally used risk tolerance questionnaires and basic timelines as the basis for portfolio recommendations. Unfortunately, these practices are riddled with flaws. As outlined below, including and prioritizing risk capacity offers a far superior method in advising clients with their investments. The Pitfalls of Risk Tolerance Questionnaires Risk tolerance, or preference, is based on […]

SEC’s Request for Comment On Digital Engagement Practices (DEPs) Puts Fintech Practices Under a Microscope

On August 27, 2021, the SEC issued a press release “requesting information and public comment on matters related to the use of digital engagement practices by broker-dealers and investment advisers.” The primary goal of the Request for Comment was to aid the Commission in determining whether or not regulatory action will be needed to protect […]

How Advisors can streamline their practice with State Street ETF Model Portfolios and TIFIN Risk

Click on the video below to watch the playback of our conversation with State Street. State Street Model Strategist Karlan Patel, CFA joined TIFIN Risk’s Co-Founder and CRO Larry Shumbres to demonstrate how State Street ETF Model Portfolios can be utilized on TIFIN Risk to streamline an advisor’s investment practice. https://www.youtube.com/watch?v=iEEg9E9eVSE