How Assessing Risk Capacity With TIFIN Risk Helps Satisfy the Duty of Care Requirements of Reg BI

One of the key components of the Regulation Best Interest adopted by the SEC on June 30, 2020, is the Care Obligation. In referring to this obligation, the SEC states that when making a recommendation, a broker-dealer “must exercise reasonable diligence, care, and skill when making a recommendation to a retail customer….” This stipulation is broken down […]

How A Proper Risk Capacity Score Helps Broker-Dealers Meet Reg BI Requirements

The Regulation Best Interest (Reg BI) rule set out by the SEC on June 30, 2020 means broker-dealers and their associated persons who are natural persons must prove that they’re acting in the best interest of their retail customers. The regulation consists of 4 components, which are: 1-Disclosure: Broker-dealers must disclose, in writing, all material facts […]

Why not having the right API strategy is not just a poor business decision, it is a client retention issue for fintechs

The Era Of Walled SaaS Gardens Is Dead Not too long ago, software platforms could live in isolation. They were built as complete waterfall technologies that served specific broad sets of needs for their clientele. Rarely, did these platforms have a need to cross-pollinate or connect with parallel or competing technologies. Then as services fragmented, […]

Take the Full Measure of Your Client’s Investment Risk – Featured on AdvisorHub

Financial advisors often don’t gain a complete picture of client risk. By using a fact-based approach to look at risk capacity, advisors can address that problem. As a financial advisor, assessing your clients’ tolerance to take on portfolio risk is a critical step in creating a suitable asset allocation and financial plan for them. Traditionally, […]

How Today’s Portfolio Risk Assessment Tools Rely On AI and Big Data To Better Serve Their Clients

Traditionally, advisors were only able to capture inputs directly from their clients. This information was often very subjective and relied heavily on the clients’ feelings about investing and risk. Fact-based questions were often limited to a small set of questions, such as time horizon and availability of assets. Even still, these “facts” were vulnerable to […]

Why Today’s Modern Advisor Needs Their Online Risk Tolerance Questionnaire To Be Part of an Integrated Fintech Platform

Gone are the days a risk assessment should be conducted on paper or in a spreadsheet. These processes are cumbersome, slow, and prone to inaccuracies. Recognizing these problems, the founders of TIFIN Risk spent over five years creating a tool that integrates with leading broker-dealers and custodians, as well as complimentary fintech partners. We focused […]

How the Right Risk Profiling Can Help You Close Clients (No, Really!)

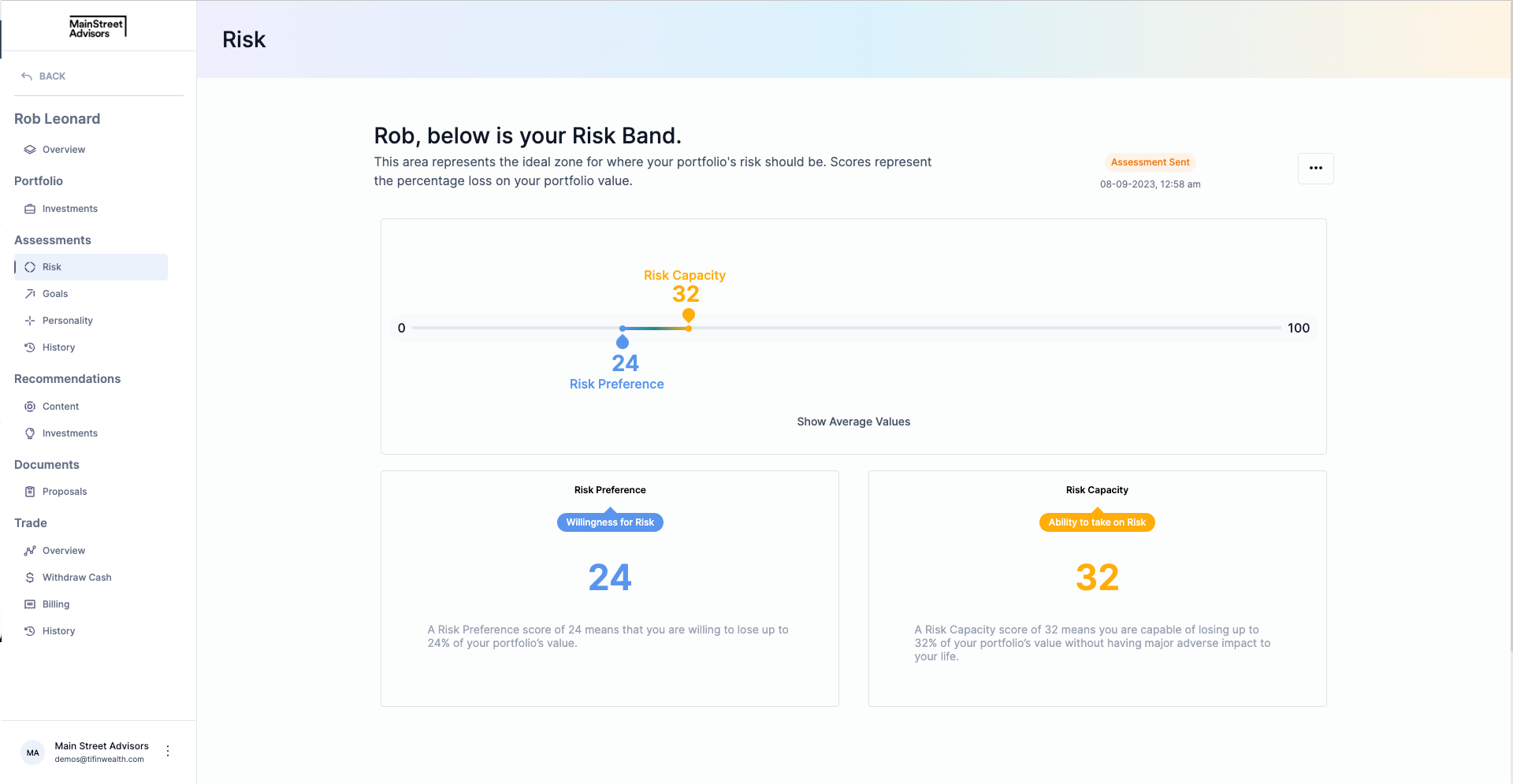

As discussed in our article Traditional Risk Tolerance Questionnaires Lead to Inaccurate Risk Appetite, risk tolerance questionnaires help mitigate biases and emotional subjectivity in investing decisions. But risk profiling through TIFIN Wealth’s Risk Alignment tool takes it a step further. Unlike other questionnaires that only provide one aspect of risk at a time, our platform […]

If You’re Only Looking at Traditional Risk Tolerance, You’re Missing More Than Half of the Equation

At TIFIN Wealth Risk Alignment, we’ve introduced a better way to quantify risk. The usual risk tolerance questionnaire for advisor includes questions about how your client feels about money and investing. This score has traditionally been the predominant, if not the sole, factor in creating a portfolio for clients. This risk tolerance methodology was a […]

Why Traditional Risk Tolerance Questionnaires Lead to Inaccurate Risk Appetite

As an advisor, you have probably been relying on financial risk tolerance questionnaires to assess a client’s risk preference. Then, depending on the client’s answers, you gear the portfolio to a more or less aggressive approach. The problem with this method is that the questions weigh heavily on how a client generally feels about investing […]

TIFIN Wealth Risk Alignment is now an approved vendor of Advisor Group

We are excited to partner with Advisor Group as an approved risk profiling vendor to its network of firms including FSC Securities Corporation, Royal Alliance, SagePoint Financial, Securities America, Triad Advisors, and Woodbury Financial. Advisors within Advisor Group can now access our unique, fact-based risk tolerance platform to better understand their clients. Schedule a demo to […]